We’ve now crunched the UK data from the second week post-lockdown with forecourts now back open and have seen the market moving from strength to strength as the release of pent-up customer demand moved to full flow. Car retailers have been awash with leads on and offline resulting in significant increases in transaction volumes (up 27%) and retail prices (up 2.3%) achieved.

The charts below qualify the market dynamics over the last 7 days in comparison to the previous week with the full year trend data shown at the bottom in yellow:

Data powered by Cazana

The charts show that used car sales have seen an uplift of +27.1% on the previous week which is impressive, to say the least. This comes off the back of an increase of +29.6% the previous week and one must accept that the boost in sales must be nearing its peak. New retail advert listings for the week increased by a more sensible +7.1% although that brings forward the stock supply concerns mooted in last week’s Price Watch insight.

Of note is that the Average Price of a car in the market today dropped by -9.5% on the previous week. This suggests two things, firstly that there has been a surge in sales of younger vehicles meaning the remaining cars in market are older and cheaper. Secondly, it could indicate that there has been an increase in the number of older cars in the market with a lower asking price hence driving the Average Retail Price down.

On another note, the Cazana Used Car Retail Price Index, which is based on normalised data, shows an increase of +2.3% on the previous week. This shows that retail pricing is increasing overall, and this is not a surprise given the current market conditions. The issue of replacing the sold stock with cars from the wholesale market is becoming more prevalent. Wholesale pricing overall is moving upwards and the conversion rates for auction sales have rapidly increased whether they be online or physical. The logistics sector is trying to get back up to speed to ensure defleet processes from Fleet users are quicker, whilst also trying to satisfy retailer needs to move part exchange vehicles off site and into the wholesale remarketing process.

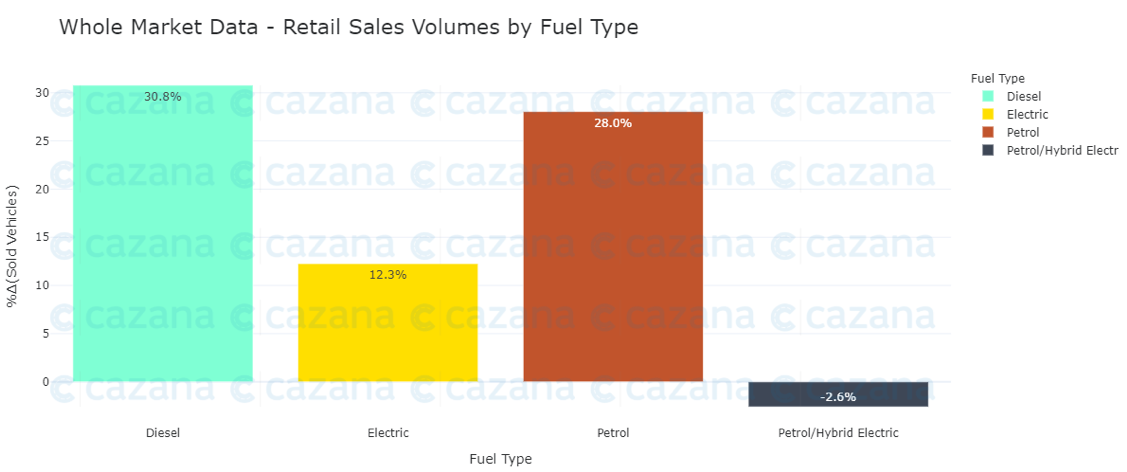

In the first week after the showrooms opened, the retail market saw a significant +65.6% increase in the number of petrol hybrid used car sales which some have agreed is due to the customer profile for these cars being unwilling to buy online. This was an interesting observation and seemed to epitomise the customer type for that sort of car. On the basis that the shift was so big for the previous Price Watch the chart below revisits this view of the market: – Data powered by Cazana

Data powered by Cazana

The data in this chart shows the change in retail sales volumes by fuel type week on week and it is perhaps comforting to see the stability in sales for Hybrid cars as it would have been unsustainable to see another huge increase in volume. Perhaps of interest or concern is the big jump for diesel powered cars at +30.8% and Petrol cars at +28% where the uplift for BEVs is just +12.3%. It would be good to think that the lower increase in BEV sales is because stock availability is an issue although it is likely that this is not the case. Consumer demand is still not where it needs to be for these often low driving range industry pioneers.

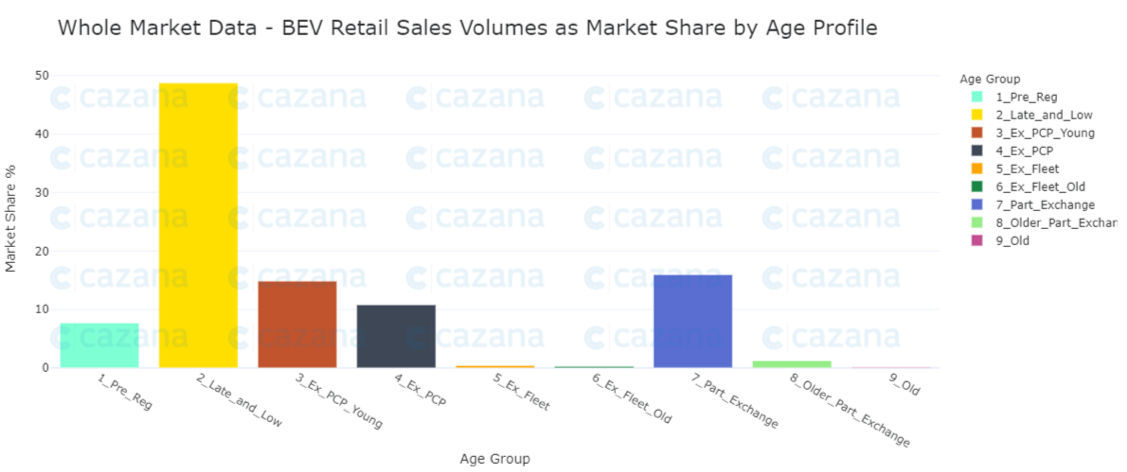

With this in mind, the chart below looks a little further in to the market performance by looking at what happened with retail sales week on week for BEVs: –

Data powered by Cazana

The volume of BEV sales in the whole used car market is still extremely low and this is to be expected given the youth of the propulsion type. This is evident from the shape of the data displayed in the chart above. Of specific note is the fact that there are minimal volumes of BEVs coming from the Fleet sector of the industry and this is disappointing at best. The challenge from the fleet sector would be that driving range is not acceptable for a fleet car although fleet cars take many forms, and not all do high mileage and as such, this has been a lack of product relevance and sales focus.

In conclusion, the Cazana data shows that the UK automotive sector is in a very positive state at the moment. Retail sales are growing, and the retail consumer has come back to the showrooms in volumes that many did not expect. The retail demand is driving the need to find replacement stock at what may well be an unsustainable pace given the supply constrictions that will be evident for some weeks to come yet. Retail demand is driving wholesale pricing upwards and margins may be under pressure, but this is certainly the best position the market has been in for many months. This remains an opportunity for the retailers to make up lost ground. Using Cazana real-time data will highlight the opportunity and showcase the folly of “sales events” and dropping retail pricing at a time when it is just not needed.