Last week saw a change in the weather as the UK began to enjoy a very long-awaited taste of summer, which whilst terribly enjoyable, is not always a good sign for the automotive sector. The feedback from the retailers was mixed, and both new and used car sales faltered slightly for some and the improved climatic conditions have taken the blame for the decline in sales activity right now.

New car sales were running at a lower level than expected for the month, and that means the forthcoming SMMT data is likely to show a decline in comparison to the same period last year when the next figures are released. This registration data may in part reflect slower market conditions, but it may also be a result of the widely discussed semi-conductor shortage. However, if there was a miraculous recovery in the final days of May, then the industry will know it will have been due to a shortage of customers and not electronics. Pre-registration will have once again taken hold.

The used car market has been tough as well and retailers reported a drop off in the number of customer enquiries. This was not a huge drop, but enough to result in some minor alarm bells ringing around what may happen if the good weather continues and consumers start thinking more of holidays and leisure expenditure rather than buying a car.

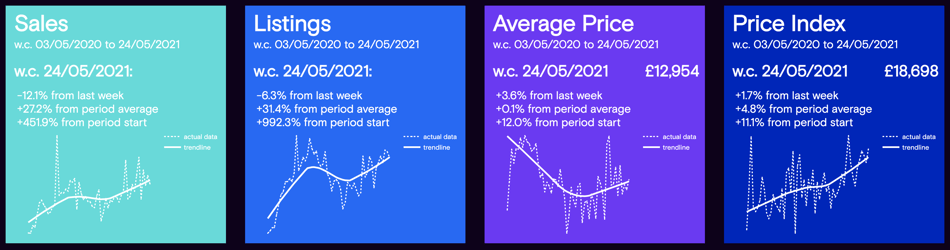

The charts below qualify the market dynamics during the previous week with the full year trend of the data shown at the bottom of each panel: -

Data powered by Cazana.

The charts above qualify exactly what happened in the UK used car market last week with used car sales dipping by -12.1% on the previous week. It is fair to say that the used car market at the moment is actually quite volatile on a day-to-day basis. Whilst some might have you believe that pricing is universally going through the roof, the reality is that the number of cars showing large wholesale price increases has to be fairly small as the retail data is not reflecting the enhanced pricing at the moment. The other alternative is that the retailer is taking a short metal profit and maximising income on the F&I opportunities.

The Cazana Used Car Retail Price Index has increased this week by +1.7% which is great news, taking the figure to £18,698. When looking at the period from the beginning of April 2020, the Cazana Used Car Retail Price Index has increased by a considerable +11.1% supporting the longer-term view of retail pricing inflation. This week, the Average Retail Price of a car has also improved and now sits at £12,954 and suggests an increase in the number of higher priced and perhaps younger cars in the used car marketplace.

Concern around the volume of used cars available in the wholesale market remains a point for discussion. With used car sales taking a step backwards, there may be the opportunity for a bit of redress, although this stock position is still likely to continue for another six weeks or so until the summer holidays take place. The best advice is to use the real-time data available and price to the market, yet at the same time do not seek to turn the stock too quickly. Empty spaces on the used car forecourt make no money!

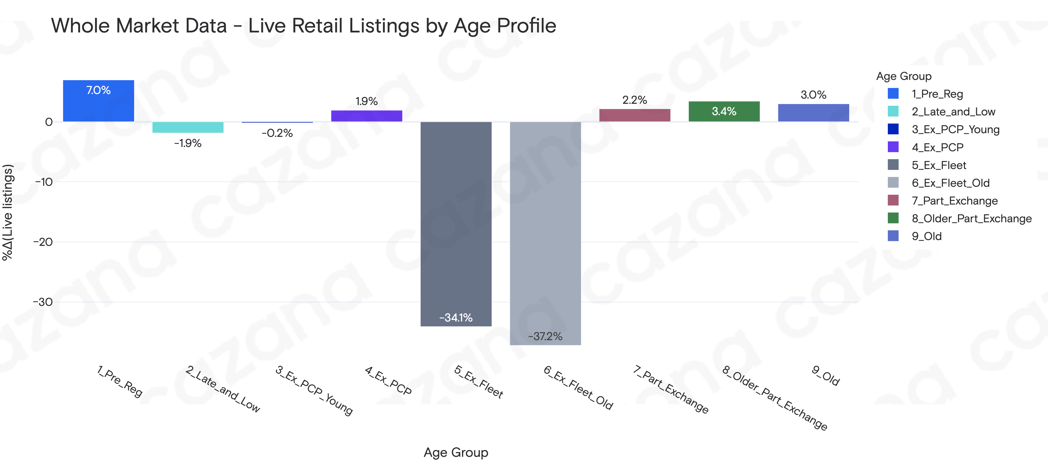

Looking at the market position in a little more detail, the chart below puts a lens on live vehicle listings by age profile to see if there is any increase in the number of younger cars in the market week on week that might have been responsible for the uplift in the Cazana Used Car Retail Price Index :-

Data powered by Cazana.

This data provides an interesting view of what has happened week on week and there is a clear indication that the volume of Pre-Registered vehicles has increased. Cross referencing this against the earlier view of reduced new car sales and there is a suggestion here that the final month figures might see a further increase in tactical pre registration activity. This would be odd under the circumstances where there is widespread talk of a shortage of new car stock as Pre Registration is about sweeping up unwanted new car volumes.

Conversely there has also been a big drop in the number of Ex Fleet profile vehicles in the used car market. This is likely to be because of delayed business profile new cars or a lag in the defleet and remarketing supply chain and is certainly something to be watched closely in the coming weeks.

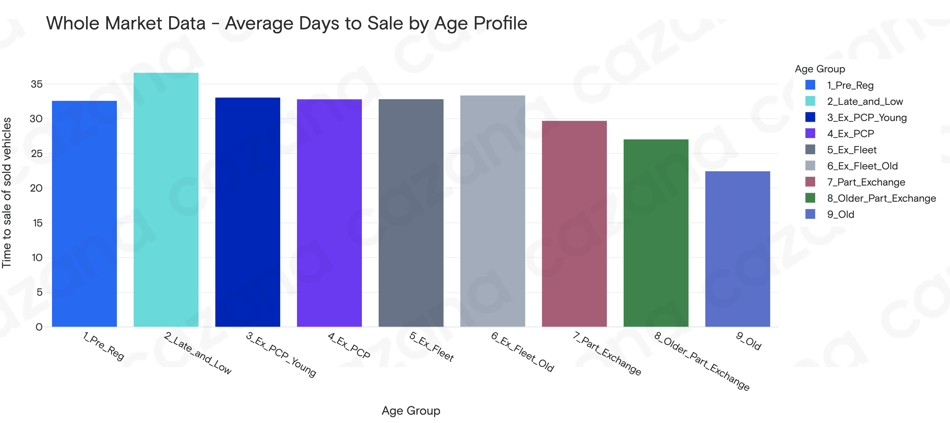

On another related topic, as there is much discussion focused on stock and market demand, the chart below looks at the current speed of sale for cars by age profile :-

Data powered by Cazana.

This chart is interesting as it gives context to the whole market average of 29 days to sale and shows that the quickest cars to sell are those that fit into the Old Car age profile. This might be something of a surprise at the moment as both pricing and stock availability for this profile have proven to be somewhat volatile in the last 6 weeks. Of equal note is the fact that Late and Low profile cars are taking so long to sell. This could imply excess volume in the market or that retail pricing is too high for the level of retail consumer demand. What is certain is that greater detail and real time data would provide a better answer.

In summary, automotive sales activity in the last week has not been what was expected, and the new and used car markets are both demonstrating some interesting demand patterns which may be related to stock supply or indeed other retail and leisure distractions. What is clear is that the vibrant conditions are perhaps not as consistent as they were before, and as such highlights the need for quality real-time insight to support robust and profitable commercial decisions to facilitate improved stock turn and profit whether that be for remarketers or retail vendors.