Last week, automotive market activity remained positive, and sales performed in line with expectations given the current stock replacement position and the time of year. New and used car enquiries were at a slightly lower level than of late, making the sales conversion process a little more important to maximise on the opportunities coming into the sales teams.

The big topic of conversation in the industry remains what is happening with used car pricing, and the last 7 days has seen a variety of messages surfaced in the press. There is no doubt that the used car market remains the centre of attention for the retailers in the face of reduced new car supply. The national press coverage has also helped consumers to realise there is a problem too and as such, there is further increased interest in used cars. The question on every retailers mind, is how to keep up with used car demand and stock requirements and at what level retail pricing should be set. The last week has seen realisation dawn, and there was a marked upward move in retail pricing, whereas this had been less noticeable in previous weeks as retailers were reluctant at times to take the risk of an upward shift for fear of damaging sales demand and subsequent sales volumes.

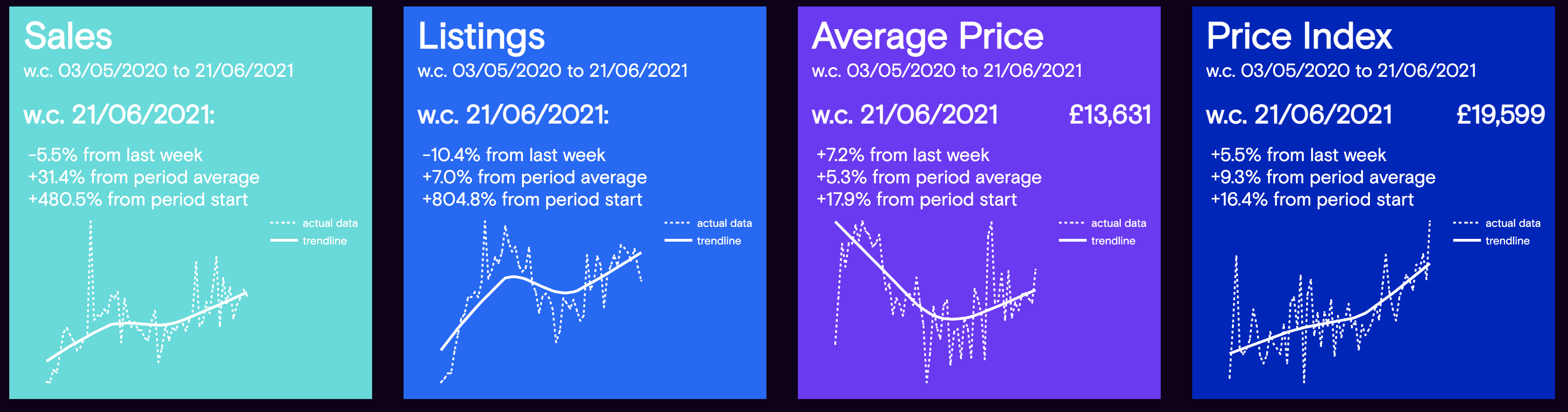

Retail driven insight has been critical of late to ensure that the retail consumer trends have been recognised quickly and strategy adjusted to match demand wherever possible. The charts below qualify the market dynamics during the previous week with the full year trend of the data shown at the bottom of each panel: -

Data powered by Cazana.

Although the data in the charts shows a decline of -5.5% in sales during the week commencing June 21st, it is important to understand that this is not a big shift and that the volume of new listings coming to the market, which show a decline of -10.4% week on week, will have affected the choice of car available to consumers. This is perhaps a direct impact of the current used car stock shortages and highlights the need to delve into the data in more detail, identify where the pressure points are and devise a strategy to overcome the problem.

The trend of a shift in used car strategy has been evident of late as retailers have sought to stock and sell older used cars that have come in part exchange and at the same time tried to sell brands and models they have not sold hitherto. Both scenarios have brought a level of operational difficulty and prep cost inflation for many retailers.

From a pricing perspective, the Cazana Used Car Retail Price Index increased by +5.5% which is quite a jump, and directly reflects the position in the market as retailers take the initiative on pricing of new used car stock with a profitable margin and at the same time also stretching margins on cars that have been on the forecourt for a while by raising those prices too. This has been a difficult decision for those retailers working with strict ageing stock policies but is entirely appropriate for the current market. This position is further clarified by an increase in the Average Retail Price of a car in the used car market of +7.2% to £13,631.

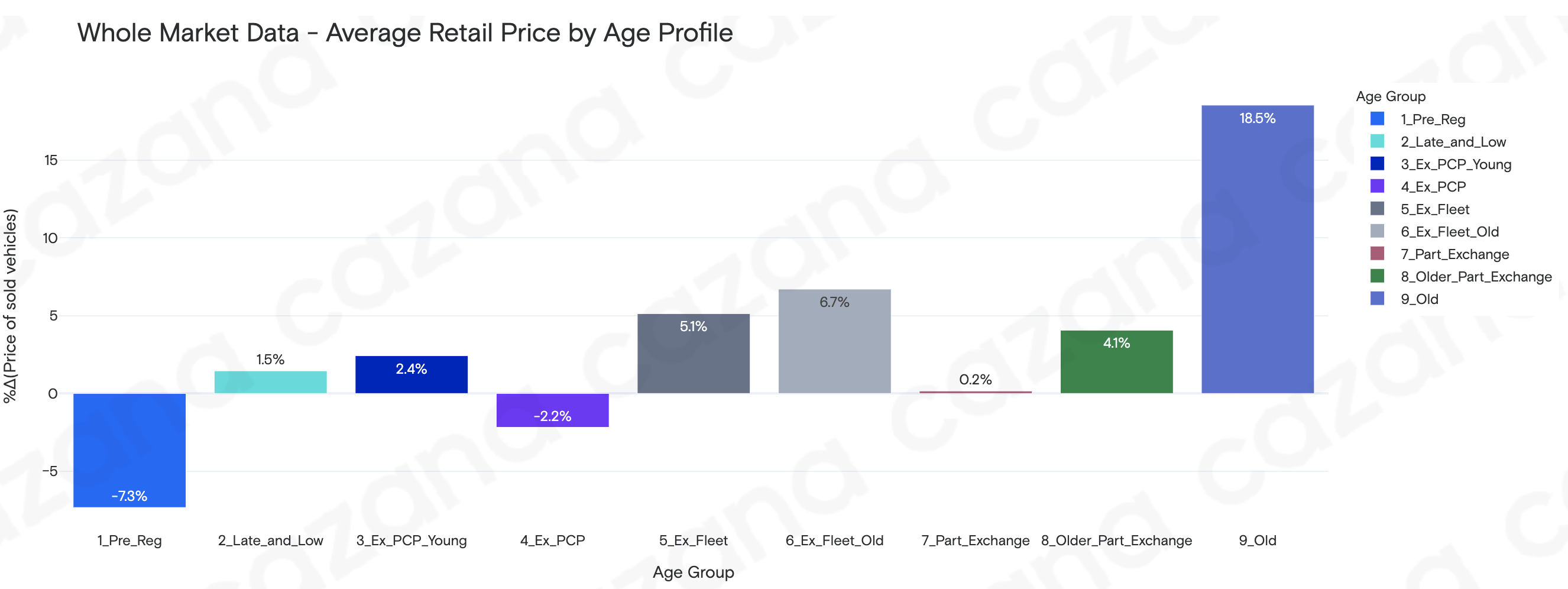

Given that there has been a significant jump in the Average Retail Price, the chart below looks at the data in more detail by Age Profile to see where the trend originates from: -

Data powered by Cazana.

The biggest shift in Average Retail Price comes from the Old Car age profile which is interesing as this has been a volatile area of the market of late. In addition to pricing, the demand and listing volumes have also been very variable over the course of the last year as retail consumers have sought to find other ways to commute, rather than use public transport, with the solution often being a second or third older, cheaper car than a main family vehicle. In fact looking at the data in more detail and although there was a +18.5% increase in Average Retail Price, week on week the sales volume dropped by a significant -28.1%. The suggestion here has to be one of supply against demand.

Also of note is the marked drop in the Average Retail Price of Pre Reg cars. This suggests that there are more cheaper cars on sale and this may be the case as the Pre Reg sector enjoyed a 45.3% increase in Pre Reg sales week on week.

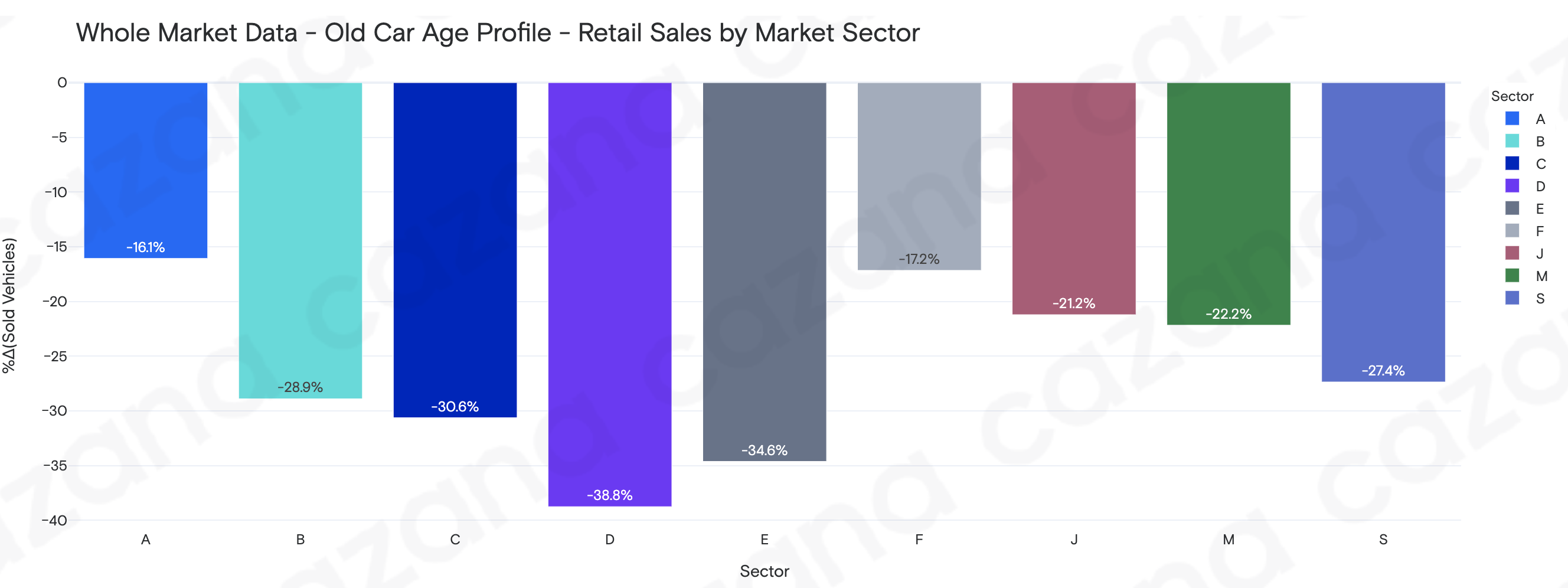

The chart below looks to give more context to the drop in used car sales for the Old Car age profile :-

Data powered by Cazana.

The previous chart is interesting as it clarifies the spread of sales decline by market sector and as such it is evident that sales of D Sector or Large Cars were significantly affected. It was the F Sector or Luxury Cars that were least affected. That is an odd pattern for Old Car pricing to be fair and as such a more in-depth view of the number of listings of Old Cars week on week reveals that they dropped by -15.5% in total, hence suggesting that sales dropped at the same time that the number of cars on sale reduced.

In summary, last week proved to be a little more challenging once again, with a drop in used car sales partnered with significant increases in the Average Retail Price of a car market wide and also an uplift in the Cazana Used Car Retail Price Index. It is likely that this is the result of a reduction in used car stock availability and as such it is vital to be fully aware of the changes in retail trends and pricing on a day-by-day basis.