The last week has been full of concern over the current levels of sales activity in the UK retail sector as a whole as the nation battles with an ever-growing tide of COVID cases. The government has been looking at the measures currently in place to stem the flow of infection and as such, there is the likelihood of further and more extreme restrictions on the freedom of movement and trading levels currently permitted by the public. This is without a doubt a low period and the impact of new stricter measures will potentially further damage the economy overall and most importantly the automotive sector.

As it stands today, the vast majority of the industry is abiding by the rules and the click and collect sales process adopted by as many car retailers as possible is generating sales at around 60% of normal levels. However, there is the possibility that this will be curtailed should a full cessation of sales to all but keyworkers be implemented. This is a delicate time for the country and there is no doubt that it is affecting consumer demand levels.

The charts below highlight the market conditions experienced over the last week with a full year trendline shown in yellow: –

Data powered by Cazana

The data shows that the biggest change in the last week has come in the form of a decline in sales which affirms the market sentiment at the moment and indicates a drop of -34.9% over the previous week and a total of -45% from the average sales levels overall. On a more positive note, retail advertised listings have only declined by -4.8% suggesting that retailers understand the need to keep digital forecourts full and appealing to potential customers.

From a retail pricing perspective, the news is even better and the data highlights that overall retail pricing increased by some 0.2% over the previous week. Whilst this may not be a significant figure the relevance is in the fact that there has been no rush by retailers to drop prices to attract business. Frankly speaking, there is no need to do so for the time being. As the industry learnt during 2020 retail price drops did not materially increase sales volumes and the consumer is more interested in the car they want rather than being tempted by just any cheap vehicle that might meet their needs but not satisfy their desires.

The other key consideration is that experience following the lockdown periods in 2020 showed that following the reopening of car showrooms there was a burst of pent up demand. The majority of businesses have made contingency plans to be able to cope with current conditions and although not ideal, a further enforced delay in trading is feasible.

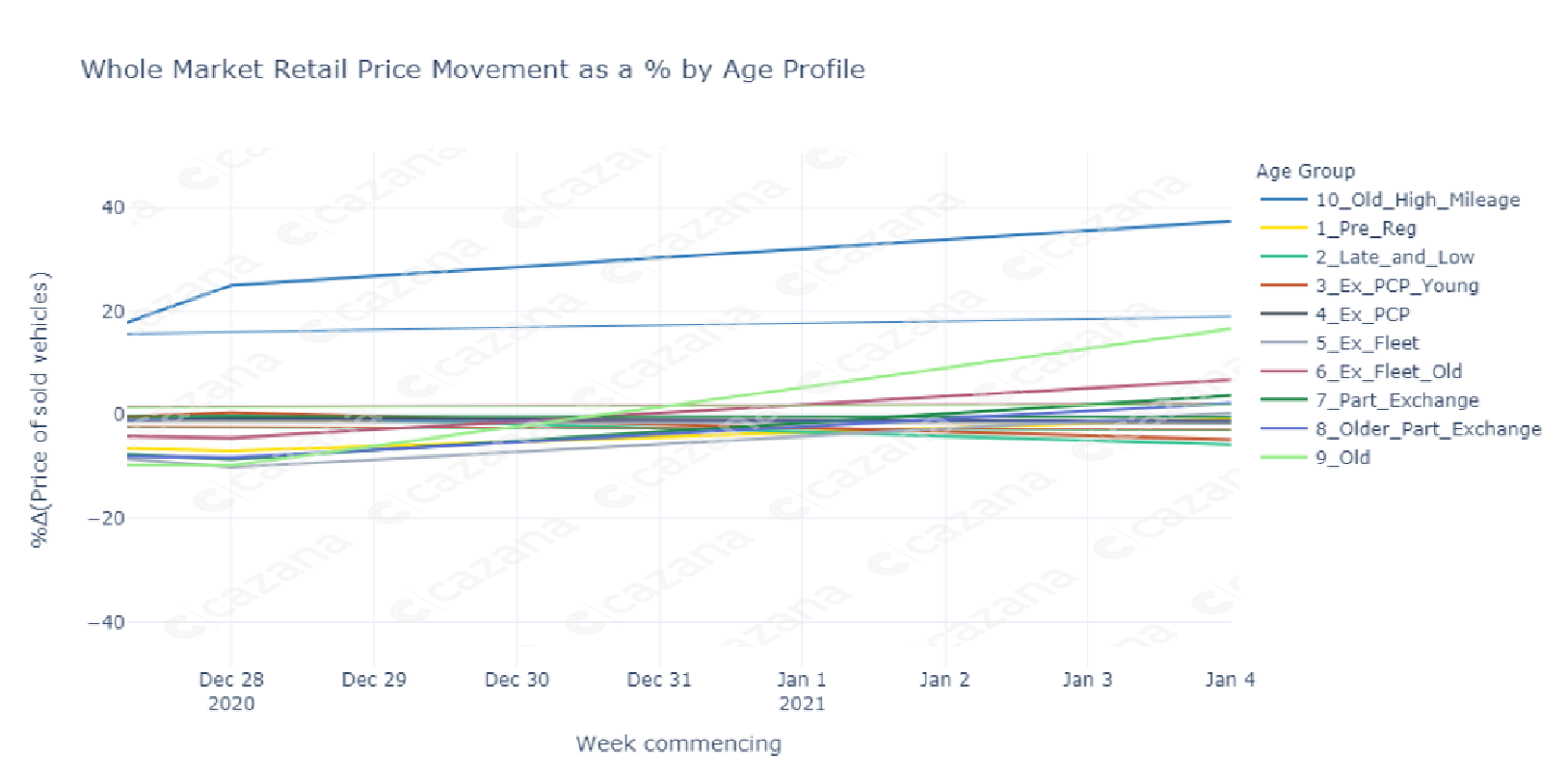

Looking at retail pricing for week commencing January 4th against the previous week, the chart below shows an interesting portrait of the current pricing landscape:

Data powered by Cazana

It is immediately clear from this chart that THE older end of the market showed a significant upturn in pricing and the largest increase is evident for the Older High Mileage cars with an uplift of 37.3%. It is important to acknowledge that this profile represents a very small percentage of the overall market but also key to recognise that this is supported by a jump of 16.6% in retail pricing of Old Cars meaning vehicles of over 10 years in age. This is followed by the Ex Fleet Old profile which experienced an uplift of 6.8% although this profile is also very small.

In contrast, the Late and Low profile recorded the largest drop in prices at -5.7% and given this accounts for a significant proportion of the overall market this helps offset the overall price movement to a market wide increase of 0.5%. This is closely followed by the Ex PCP Young profile with a dip of 4.7% in pricing.

There is little doubt that there are some interesting dynamics at play in today’s market and this poses all sorts of issues for retailer nationwide. With such swift and widespread shifts in retail pricing it can be very difficult to address the opportunities as they arise and at this point in the overall market the ability to identify and address opportunity is second to none which is why live retail pricing is essential for modern auto retail pricing.

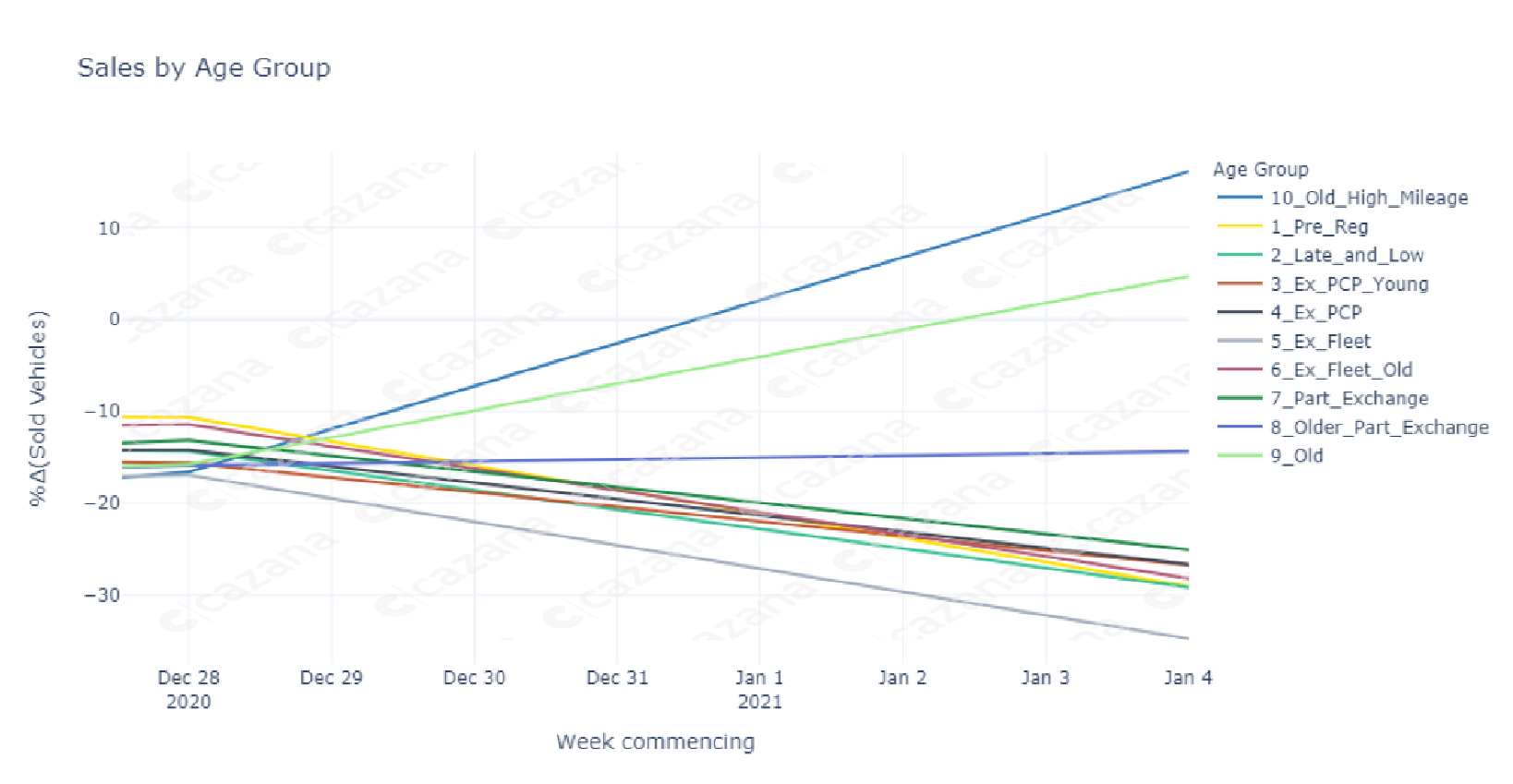

Looking at the market from a different perspective the chart below looks at sales performance week on week by age profile:

Data powered by Cazana

Given that we know that sales were down by -34.9% week on week the chart above highlights the volume of sales by age profile. It is interesting to note that comparing the last two periods it is the older car profiles that have once again shown an increase in sales volume. The Older Car sales profile representing vehicles over 10 years old increased by 4.7% and Old High Mileage cars showed a significant increase of 16.1%. The best of the rest was the Older Part Exchange profile showing a drop of -14.4% and as such, it is clear that older vehicles have the sales momentum at the moment. The concern here is that perhaps these vehicles are being sold by smaller retailers who are not abiding by the lockdown rules, however, it could also indicate that the demand for cheap transport has bounced again in the face of the spread of the virus as it did previously during lockdown 1.

Looking at the poor performers, it is the Ex Fleet cars that recorded the largest drop in sales with a decline of -34.75%. This is slightly worrying on the face of it but Cazana can provide further analysis to identify where the issues lay. What is obvious is that any car under the age of 7.5 years old has been hot with a significant drop in sales and thus in line with the headline data.

To summarise, the 2021 New Year market has been unique in the fact that unlike previous years it has not come with a marked increase in sales. This is by no means to say that once the lockdown is over there will not be a bounce of pent up demand to bring the year back in line with expectations although it is very difficult to identify what the expectations should be for the coming 12 months with so much being dependent in the insidious COVID infection. What is clear is that right now the automotive industry is holding its breath to determine whether a full shutdown will put the majority of sales on pause or whether the economy can be sustained that little bit longer.

It is important to recognise that Cazana are in the unique position of not having its core data sources impacted by the reduction or cessation of market activity. Given the automated advanced technical nature of the data collection and being focussed on a retail back methodology there is no other whole market data source available to the industry. As proven during the first lockdown, fact-based data devoid of human editing is the only way to ensure the highest and most relevant “industry standard” quality of data on which modern automotive businesses can base commercial strategy that will maximise stock and ROI opportunities.