Week Commencing January 11th to January 4th 2021

January can be an interesting month for the automotive sector and has historically been a period of both improving sales and increasing retail pricing. Given that this seasonal boost has waned in recent years and the market standard for data reporting has shifted from month to at worst weekly updates, the second week of January had been of great concern to the industry as a whole. The sales trajectory under the current virus management measures and Lockdown 3 was under great threat and the positive news is that although sales are lower than would have been the case a year ago, the impact has been less than anticipated.

Retail consumer demand in the used car market has remained consistent and the online sales journey coupled with a click and collect or delivery services seem to be working well. Retailers have remained sensible over the furlough position and customer service levels appear to be of high quality and thus encouraging online sales nationwide. Of note is the action taken by one retailer who has decided to halt sales completely during the lockdown although this seems to be an isolated view and with the right care, safe collection and delivery of cars is widely accepted as feasible and achievable which means that the “new normal” is working for the time being

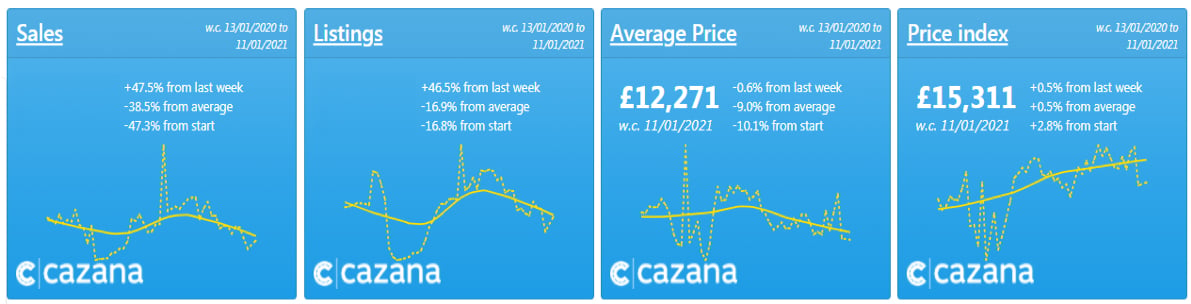

The charts below highlight the market conditions experienced over the last week with a full year trend line shown in yellow:-

Data powered by Cazana

This week’s data highlights that the second week of January has seen quite an improvement in sales activity with an increase of 47.5% over the levels in the previous week. Whilst the full year trend is still in decline this is a welcome boost for the retailers and therefore the wholesale environment. In addition, the second chart from the left also highlights that that number of new retail adverts is also improving with an increase of 46.5% over those added during the week commencing January 4th offering retail consumers more choice of stock.

In addition to these positives, the market also saw an increase in the Retail Price Index highlighted in the fourth chart on the far right. At 0.5% for the week with an Average Retail Price of £12,271 per sold car in the UK market today this represents a jump in the pricing of £61 per car. It is wise to note that this drop in Average Retail price is a drop of -0.6% from the previous week and this also represents a drop of -10.1% in average retail price in the last year in part highlighting the increased demand and subsequent sales of older cars during the course of the full year. However, the positive is that the Retail Price Index shows that pricing over the last 12 months has increased by 2.8% overall.

Looking at retail pricing in more detail for week commencing January 11th against the previous week, the chart below shows an interesting portrait of the current pricing movements: –

Data powered by Cazana

This chart shows the retail price movement as a percentage week on week broken out by key age profile and given the overall market price movement was an increase of 0.5% there are some interesting changes in the data on closer analysis. The majority of age profiles are showing an uplift in retail pricing which is good news and also of note because this weeks data suggests that perhaps the historical seasonal uplift is still in play. It also highlights that traditional new year sales promotions have not been a big part of the industry and this is likely due to the current lockdown but also suggests that retailers have learnt that in the current climate there is no need for them to discount prices to generate sales where the retail consumer is keen to find a specific car of their choice and benefit from a safe and secure sales journey.

What is also evident from this chart is that the older age profiles are the ones that have been suffering in the last week period. This is of note as it suggests that those older cars that are sold through the smaller retailers and traders are the vehicles that are showing a price drop. This is possibly because these cars are selling in less volume as it is the larger retailers that sell the later plate newer cars and that those retailer’s have in general adopted the online journey more successfully.

On this basis, it is a possibility that older vehicles are selling more slowly perhaps as a direct result of perceived trust in a smaller retailers capability of safely handling sales during this lockdown period or that the online profile of the smaller retailers is not as high profile as the larger retailer groups. There is probably of a mix of both sentiments at play.

It is fair to say that in the last 6 months retail pricing for older cars has shown higher levels of volatility overall and as a result, this is an area of the market that needs to be monitored closely with some regular in-depth analysis to spot market nuances and opportunities.

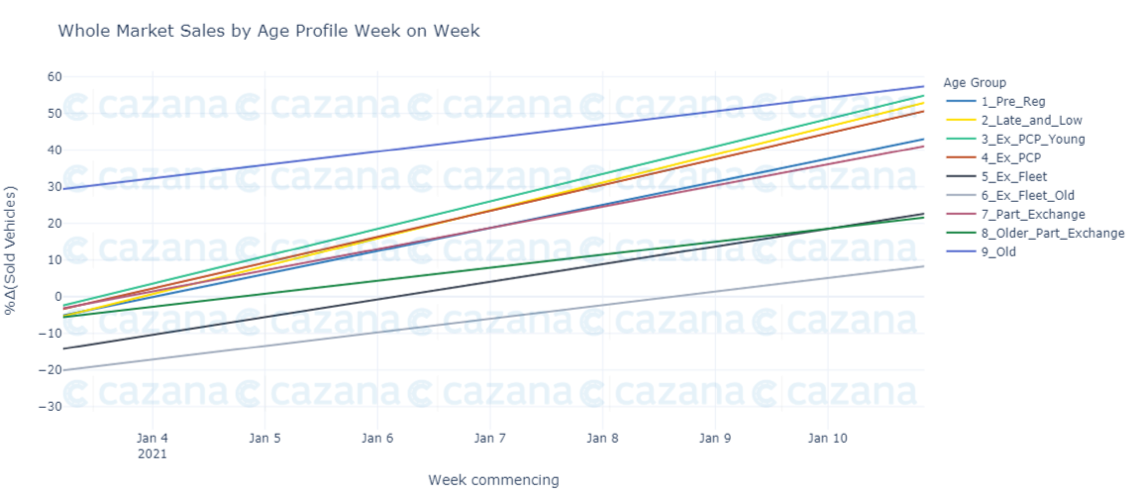

Looking at the market from a different perspective the chart below looks at sales performance week on week by age profile:-

Data powered by Cazana

The chart shows what the volume of sales were as a % in relation to the previous week and the good news is that this gives context to the data in the summary plots at the beginning of the document where the high level increase in sales was identified as being an uplift of 47.5% on the previous week. Every market sector except for Ex Fleet Old, has shown an improvement which is very encouraging although there is a possibility that until Lockdown 3 ends, week on week volatility may creep in. That will provide both opportunities and threats that only realtime insight can help resolve.

In conclusion, the last week has brought both challenges and opportunity to the UK automotive sector. Lockdown 3 remains a blocker, and the general public continues to take pleasure in finding holes in the advice given by the government that will inevitably result in a longer lockdown period. The positive is that consumer demand has not disappeared, and modern automotive retailers are striving to meet the demands of what many are temporarily referring to as the “new normal”.

It is important to recognise that Cazana are in the unique position of not having its core data sources impacted by the reduction or cessation of market activity. Given the automated advanced technical nature of the data collection and being focussed on a retail back methodology there is no other whole market data source available to the industry. As proven during the first lockdown, fact-based data devoid of human editing is the only way to ensure the highest and most relevant “industry standard” quality of data on which modern automotive businesses can base commercial strategy that will maximise stock and ROI opportunities.