The used car market in the last week has recorded some very interesting activity as retailers continue to work with Lockdown 3. The virtual showrooms are working hard at generating new leads which would appear to be notably improving day by day and with the month well underway sales appear to be exceeding expectations.

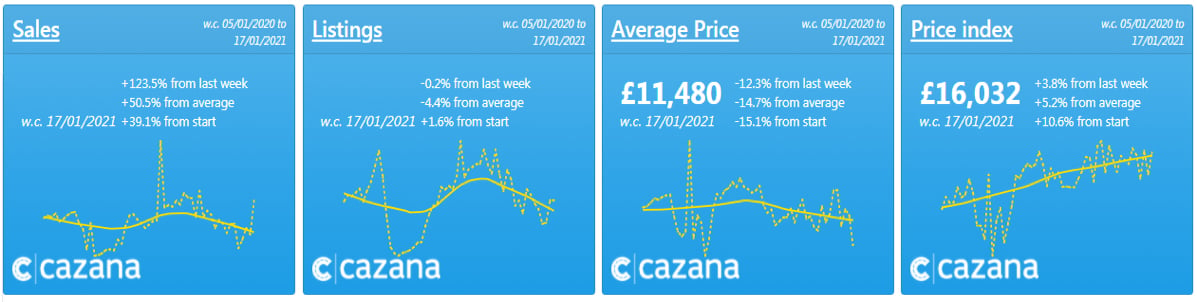

The charts below highlight the market conditions experienced over the last week with a full year trend line shown in yellow: –

Data powered by Cazana

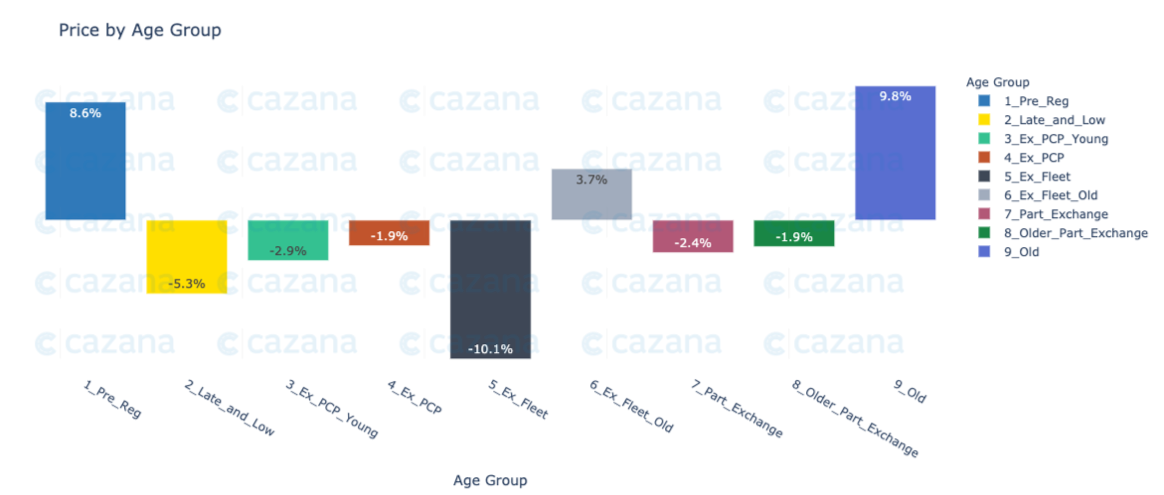

However, the used car market is showing some fascinating nuances, and the chart below looks at headline Retail Price movements by key age profile to put some context into the increase in the Retail Price Index recorded over the week commencing January 11th. It is also important to consider the drop in average retail price for sold vehicles which suggests that sales activity has been focused on the Older Car profile.

Data powered by Cazana

The previous chart qualifies the overall increase of +3.8% in the Retail Price Index week on week, and it is clear to see that there have been two age profiles that have seen a marked increase in retail price. As suspected the Old Car age profile leads the way with a 9.8% uplift, closely followed by the Pre Reg profile at 8.6%. The one area with a notable drop is the Ex Fleet sector where prices have dipped by -10.1% although it is important to understand the volume profile of these Age profiles in relation to the total market representation which is highlighted in the chart below.

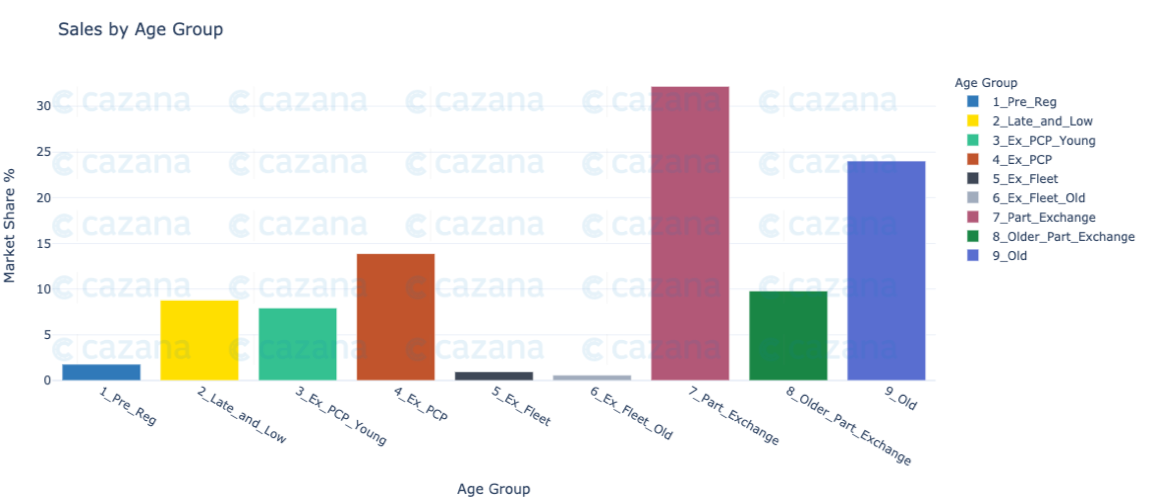

Data powered by Cazana

As the chart shows the largest retail advert market share belongs to the Part Exchange profile this week although the Old car profile follows closely behind where Retail Prices dipped by 2.8%.

In summary, the market has seen a large increase in sales and the Retail Price Index week on week and this shows a positive view for the retailers and the health of the market overall. This has been combined with an uplift on leads generated from virtual showrooms and there is significant evidence that working with realtime pricing data is helping retailers to properly adapt to the “new normal”.