March is usually dominated by new car sales activity and whilst new car registrations are reported to be tracking at a better level than some expected, the final registration volume will undoubtedly have been affected by the lack of semiconductors affecting production. There also remains mild concern that the incident in the Suez Canal may also impact new car supply for some OEMs, although Mazda and Suzuki believe that will not be the case.

Activity in the used car market in the last week has been pretty good, with retailers reporting a further uplift in the volume of enquiries as consumers show more interest in used cars. Staff are now beginning to come back from furlough as preparations gather pace for the reopening of the showrooms on April 12th. Used Car Buyers are now back in the business working with the senior management teams to understand what the retail consumers are looking to buy right now. Online sales activity has been a little slower, but this is due in some cases to the lack of sales professionals being available to service the leads quickly.

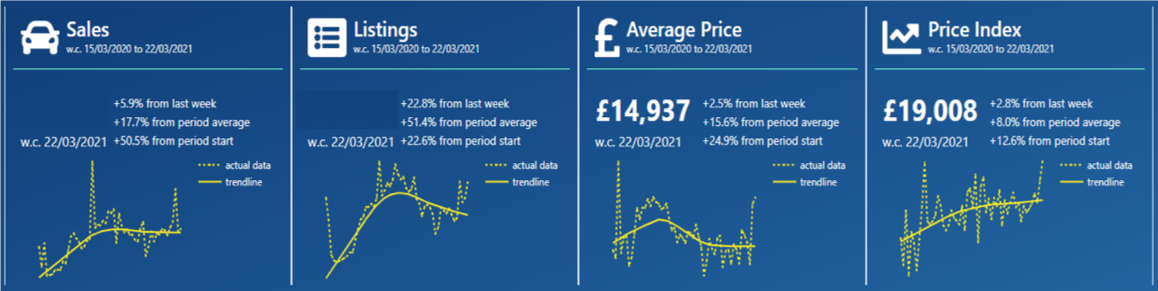

The charts below qualify the market performance over the last 7 days in comparison to the previous week with full year data shown at the bottom in yellow: –

Data powered by Cazana

The charts show that used car sales improved by + 5.9% over the previous week’s figures. With a better complement of sales staff in the business nationwide, it would have been interesting to see where that total would have led to. With buying teams coming off furlough, there has been an increase of + 22.8% in New Retail Advert Listings as the retailers increase stock levels for the anticipated surge in demand when the showroom doors reopen, which is good news.

At the same time, retail pricing edges ever higher with the Average Retail Price improving by +2.5%. and the Cazana Used Car Price Index showed an uplift of +2.8% week on week, but the really good news is that the full-year figure is up +12.6%, thus qualifying the marvellous strength in used car demand over the last 12 months. This is quite an increase and whilst there are several potentially influencing factors the simple truth is that the retailer online “mouse to house” operation capability is in a large part responsible for keeping the automotive sector going. It will be interesting to see what will happen once the showrooms are allowed to have customers on-site once again. There has been much press coverage saying that the market will revert to buying face to face once again which if true would be quite a disappointing step backwards and a significant threat to online only retailers.

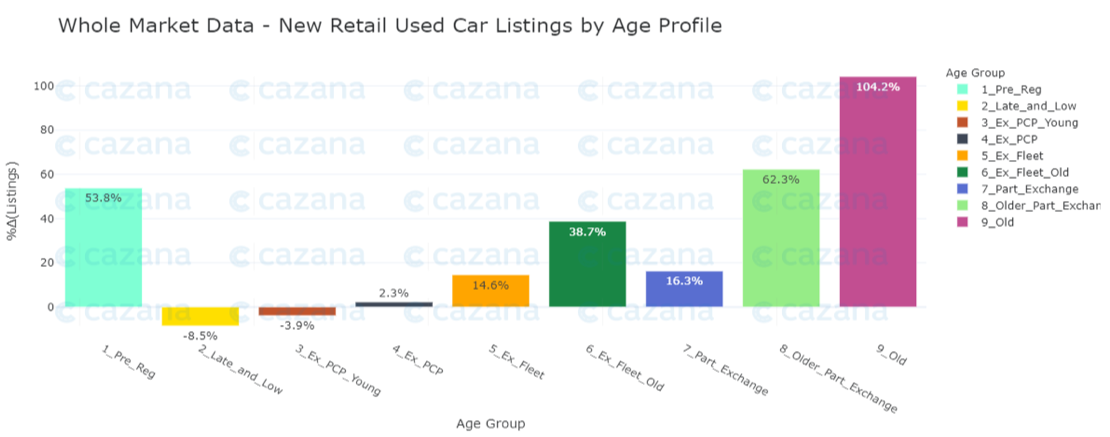

Given the significant rise in the number of used car retail listings, the chart below looks at this in more detail: –

Data powered by Cazana

The chart above qualifies the spread of the +22.8% increase in listings that was recorded last week. The ever-volatile Old Car profile sees a significant jump in the number of new adverts. This could be because Lockdown 3 is ending and the smaller dealers that did not have online operational capability are now getting themselves ready to receive customers once again. This can be seen across all age profiles from 5 years old and above. The other point of concern is the increase of +53.8% in the Pre Reg-profile, suggesting there has been some tactical registration once again.

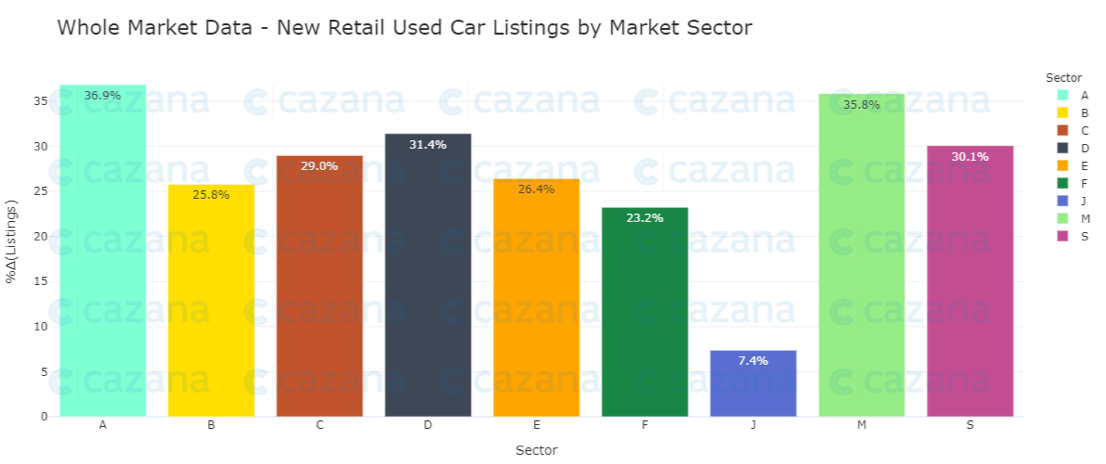

The chart below looks at this in more detail to see where the increase in retail adverts has been most noticeable from a market sector perspective: –

Data powered by Cazana

This chart is reassuring in that the increase in the number of new retail advert listings seems to be largely consistent across the different market sectors. This suggests that the rise is indeed due to an awakening of the market from a smaller independent retailer angle. Perhaps of note is the A Sector increase of +36.9% in retail adverts, and maybe this uplift in the volume of older small cars will be the market for those who want to stay away from public transport when Lockdown 3 ends properly with the reopening of non-essential shops on April 12th. The J Sector or SUV category has shown the smallest volume of increase in retail adverts at +7.4% which is interesting as there has been anecdotal comment that this sector of the market is under duress at the moment.

To summarise, the last week has been a positive period from a new business perspective with a high volume of leads for used cars. Buying staff are coming back to the business having been on furlough and are helping to ensure that stock levels will be maximised ready for April 12th. With a positive outlook for the weeks ahead, the important part will be understanding where the best opportunity lies and being able to react quickly to consumer demand as it happens. For that, realtime retail-driven insight is essential, and only this type of data will ensure remarketers make the most of the retail consumer demand, and the retailers make sure they can stock and sell exactly the right cars to maximise profit.