Sales enquiries for both new and used cars have seen an increase during the last week as retail buyers appear to have gained a little more confidence and seem more willing to start to spend the money they have inadvertently saved during the current third lockdown period. However, new car sales for the month are still looking to be at around 60% of normal levels with a considerable constraint on the supply of certain new car models making things harder still for the dealers to meet taxing OEM sales targets.

The used car market has also improved and despite reports of a lower volume of sales professionals available to handle enquiries due to a final round of furlough savings before the showrooms reopen, sales for the week were strong. Conversely, the volume of replacement stock to refill the forecourts were strained as conversion rates at the auctions rallied and on online sales figures from third party remarketing companies took a positive swing too.

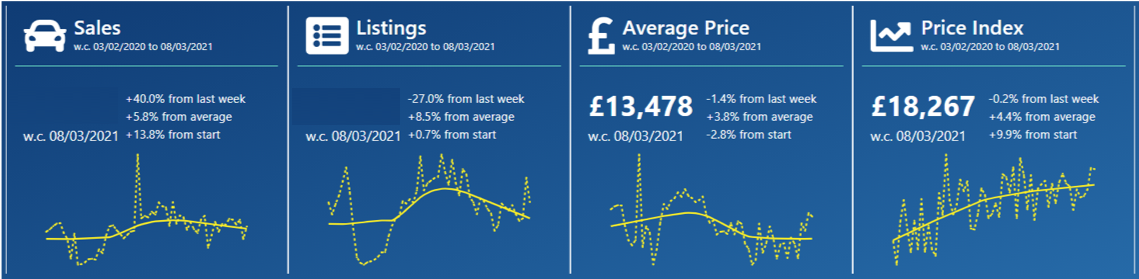

The charts below qualify the market performance over the last 7 days in comparison to the previous week with a full year trendline shown at the bottom in yellow: –

Data powered by Cazana

The charts firstly show that used car sales in the last week improved by 40% over the previous period which is very good news, and sales also reportedly ran between 80% and 90% of usual levels for the used car teams. From a retail pricing perspective, the market reflected a drop of 1.4% in the Average Retail Price down from £195 to £13478. At the same time, the Cazana Used Car Retail Price Index dipped marginally by -0.2%. On a more positive note, the index is sitting 9.9 percentage points higher than it was in March 2020.

Given the boost in retail used car sales, the chart below looks at sales by fuel type in comparison with the previous week: –

Data powered by Cazana

This chart shows that BEVs achieved the largest percentage increase in sales, followed by diesel-powered cars, which should not come as a surprise to many. However, it is important to remember that the overall volume of BEV used car sales is much lower in comparison to the other propulsion types, and last week they represented 0.8% of the total used car sales. This number is higher than it has been for some time which is another positive, but still some way behind Hybrid cars at 4.4% of the used car market and the traditional fuel types of diesel at 40% market share and petrol at 54.8%.

Looking at the market with a different lens and the chart below shows the percentage move in retail pricing by fuel type: –

.png?width=979&name=whole-market-data-retail-price-movement-by-fuel-type-as-a-%20(1).png)

Data powered by Cazana

This chart shows that not only did the volume of BEV sales increase, but the Average Retail Price of those sold cars also improved by a significant 11.3% and now rests at £31,519 per car. Given that volumes of BEVs in the used market are low, this means it is essential to look at the data in more detail to understand what threats and opportunities can be identified and acted upon in relation to the type and brand of BEV in today’s market. It is also conceivable that the volume of national press coverage in the last week in relation to the governments 2030 ban on the sale of new ICE cars may have contributed to an upturn in demand.

In conclusion, the new car market has not performed as well as had been hoped in the last week, although the used car market has shown more strength with a marked increase in used car sales. The drop in new retail used car adverts may result in a downturn in sales next week as a result, although that is by no means a given. As the country moves ever nearer to the April 12th showroom re-opening date it will be interesting to see how sales levels perform. The use of realtime, retail driven fact-based insight will be essential to keep used car commercial strategy in line with market demand.