As the country continues to be vaccinated at a tremendous rate, there is much greater pressure for the country to start to see a return to normality. The government’s announcement last week gave a welcome roadmap to the future and despite disappointment for the car retailers over the opening of the showrooms, there is still a clear way forward. However, this is still dependent on the public’s ability to follow the rules in place and make sure that even if they have had a vaccination there realise there is still the danger of spreading the virus. On a controversially positive note, it would seem that vehicle test drives have been given the go-ahead, although a number of retailers have decided they will not allow this on moral grounds.

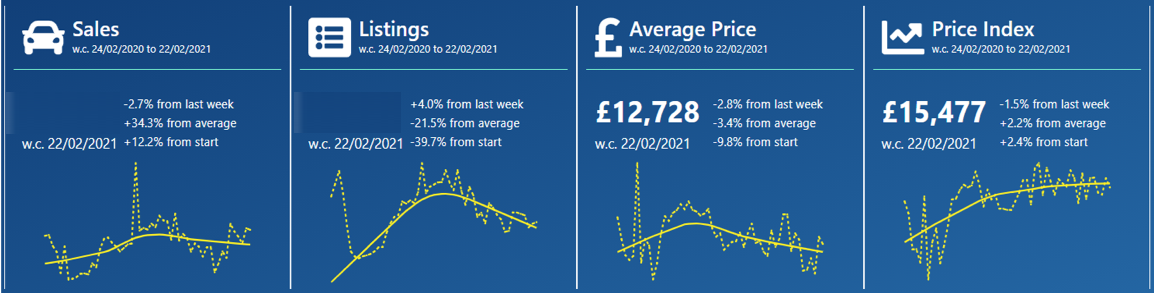

The charts below qualify the market performance over the 7 days in comparison to the previous week with a full year trend line shown on the bottom in yellow: –

Data powered by Cazana

The significant growth in sales recorded in the previous period has remained consistent with just a small –2.7% drop in sales last week. This is positive news despite the slight decline, as consistency of performance in the market will be an essential part of recovery this year. From a Cazana Retail Price Index perspective, there has also been a slight dip of -1.5% and this represents an average of just £232 per car. Historically speaking the last week of February is one of the quietest months of any year but 2021 seems to have bucked the trend despite the COVID restrictions.

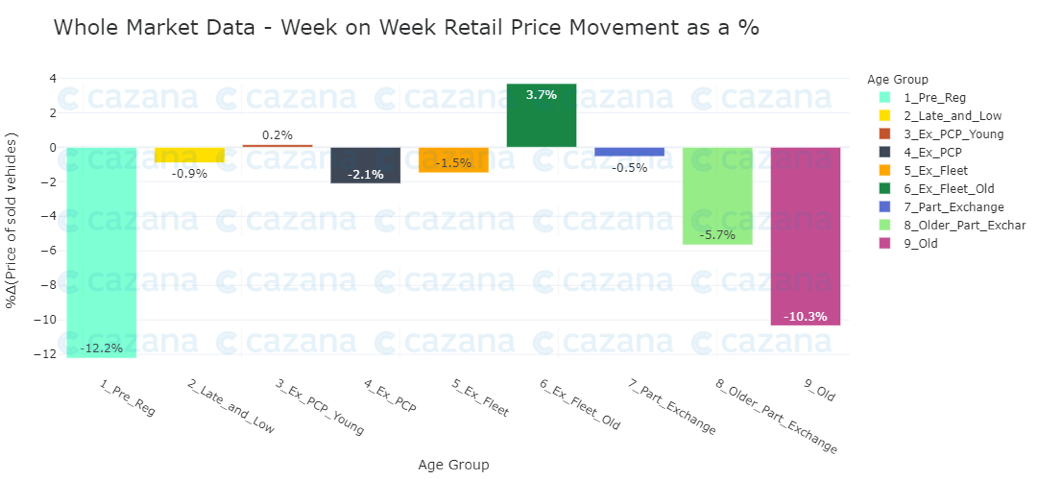

The chart below looks at retail price movements week on week by age profile: –

Data powered by Cazana

The detail always brings headline figures into perspective, and the previous chart serves to demonstrate the importance of looking into the data more deeply. This week the older age profiles have seen a swing from the previous week with quite severe drops in average retail pricing in percentage terms. However, the largest move in pricing has been for the Pre Reg age profile which is interesting, specifically as February can be a large pre-registration month of cars before the arrival of the new plate. However, this is unexpected if this is the case as OEM production has been restricted in recent months, although this could be masking specific tactical activity the details of which may become apparent when the SMMT release their registration figures later in the week.

The chart below looks at the retail pricing activity in more detail by breaking it into movements by fuel type: –

Data powered by Cazana

The chart above further emphasises the need to interrogate market nuances in more detail. As identified some time ago there is significant volatility with Hybrid powered vehicles and this chart shows the average retail price in the Pre Reg sector has dropped by -20.4% with Petrol at -14%. Now this suggests that the profile of cars in the retail marketplace has changed and that there are more, lower priced non premium cars in the market. Further investigation reveals that the pricing activity in the Lower Medium car sector may be the root cause closely followed by the Large car sector.

In conclusion, the data shows that the last week of February has been a reasonably good week particularly considering the fact that it is the week before the new reg plate comes out. Generally speaking, sales volumes at the retailers were still at around 75% of where they would expect to be for a normal week. Used car activity in the first week of March will be intriguing and the industry is beginning to constructively plan towards reopening the showrooms on April 12th. To ensure commercial success, real-time data is essential and Cazana continues to bring Industry Standard pricing and insight to its customers and the automotive sector overall.