The previous week’s despondency seems to have lifted a little and economic activity across all sectors in the UK has improved. This may have been a bit of a feel-good factor kicking in as the volume of COVID vaccinations exceeded expectations slightly and the weather took a turn for the better. However, the automotive sector benefited from increased enquiry levels and better motivated customers reaching out to the retailers, and the result was a more positive week in sales terms. The last 7 days have also seen a significant increase in lobbying of the government to take a sensible approach to re-opening retail car showrooms ahead of some other retail outlets, the efficacy of which is as yet unknown.

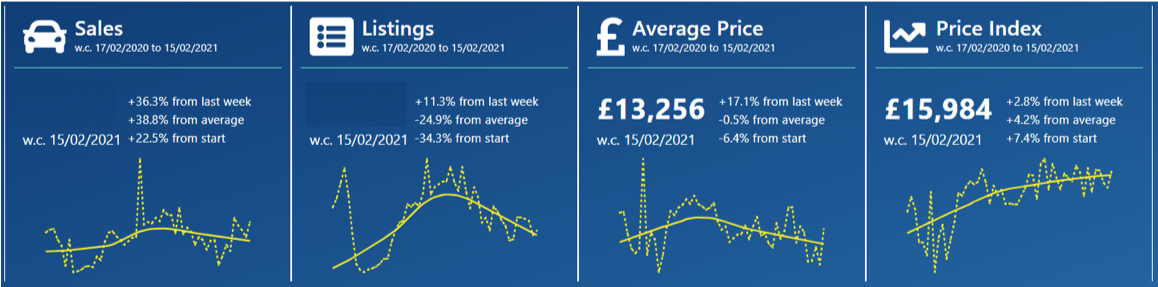

The charts below qualify the market performance over the last week in comparison to the previous week with a full year trend line shown in yellow: –

Data powered by Cazana

After a drop-in sales volume last week, it is encouraging to note there was an increase of 36.3% in the last 7 days, which if it were a sustainable weekly increase would be ideal. Sales listings were also up by 11.3% which would suggest that retail consumer demand has driven buyers to the wholesalers in search of stock. In addition, the Average Price of a used car lifted by 17.1% over the previous week which may be due to the type of cars bought by the retailers to meet consumer demand. Overall, the normalised Cazana Used Car Price Index grew by 2.8%.

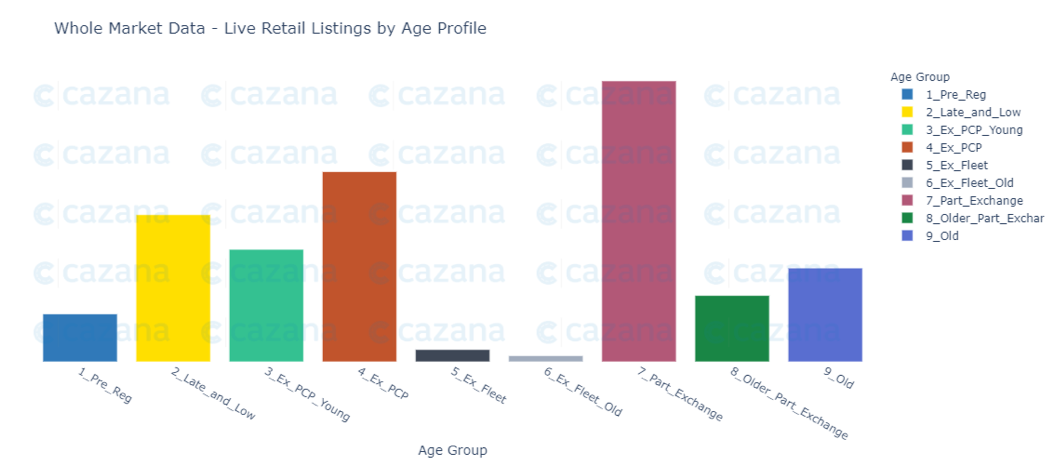

The chart below looks at retail price movements week on week by age profile: –

Data powered by Cazana

The chart shows that the older age profiles have seen an increase in the retail price of cars advertised for retail sale. Of note is the size of the increase of the Older Part Exchange and Old car profiles which on the face of it look pretty high and might suggest a big market swing, although it is important to quantify this by highlighting that the average price point is much lower. For example the Old Car average retail price last week was just £3,237. It is also interesting to note that the retail price of cars in the youngest 4 age profiles dropped slightly.

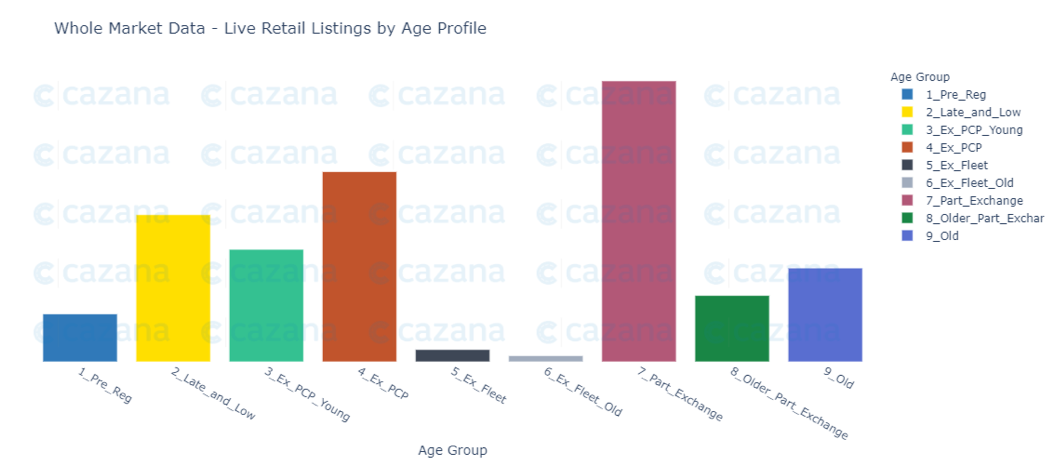

This kind of pricing activity can be a result of the volume of cars for sale in the retail market at any given time and the chart below looks at the volume of live retail adverts by age profile: –

Data powered by Cazana

This chart shows that the age profile with the largest volume of live retail listings at the moment is the Part Exchange profile. The 4.4% uplift in the average retail price in the former chart is therefore of interest as this has happened whilst the volume of retail advert listings has also increased, and it could be argued that this is not a normal supply and demand pattern. However, the average retail price decreases in the previous charts for the newer age profiles are symptomatic of the increases in retail advert volume. As established almost a year ago it is therefore evident that lockdown is still enhancing demand for older cars.

In summary, the third week of February has seen a welcome pick to used car sales driven off the back of an increase in the number of better-quality enquiries. The end of lockdown draws ever closer and as highlighted by Cazana some weeks ago there will be a short period of higher sales as the pent-up demand is released. Using Cazana’s realtime market data, will help your business identify opportunities and threats to be able to maximise commercial performance as it happens in a fair and transparent way during the remaining weeks of lockdown.