The market has hit the mid-point of the month and February looks to be less promising than had been expected for both new and used car sales. General consumer confidence seems to be under pressure and the plethora of negative stories in the national press can’t be helping the situation. It should be no surprise to anybody in the nation that the economy shrank in 2020, or that retail sales nationwide were lower. The positivity of the current position seems to be overlooked and given the current lockdown and what happened in the last 12 months the country has shown remarkable resilience, as has the automotive sector and consumers should remember this.

The charts below qualify the market performance over the last week in comparison to the previous week with a full year trend line shown in yellow:-

Data powered by Cazana

Sales levels declined by -14.2% on the previous week and this is symptomatic of the general apathy of the retail consumer. Unfortunately, the resulting dip in sales leads available to convert towards commercial sales targets has been uncomfortable in the last 7 days for most retailers. There has also been a drop in the volume of new retail adverts suggesting wholesale stock is still proving difficult to find.

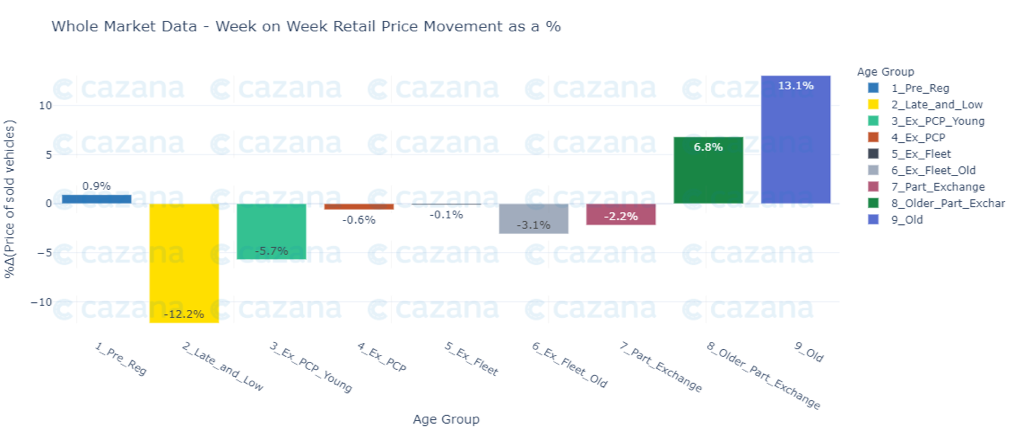

The chart below looks at retail price movements week on week by age profile: –

Data powered by Cazana

This chart is very interesting as it highlights some significant market pricing shifts and at the same time raises some questions on what is really happening in the used car market on a more granular level. In comparison to the previous week, there are 2 clear areas of change. Firstly the significant drop of -12.2% in the average Late and Low profile retail price, and the jump of 13.1% for the Old Car profile. Whilst the normalised Cazana Retail Price Index shows a minimal drop of -0.8% the detail is always of critical importance.

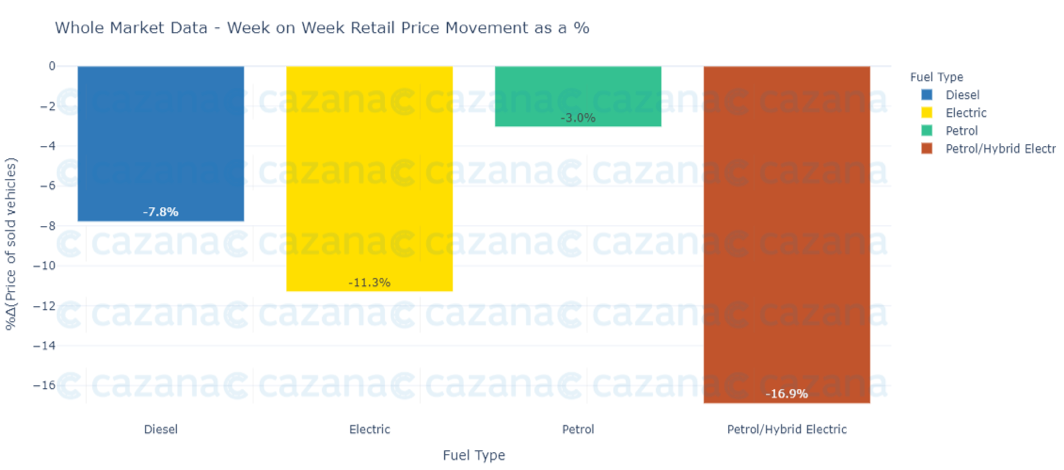

The chart below is a different lens on the market and looks at the weekly retail price movement as a % by fuel type: –

Data powered by Cazana

A fascinating view that shows that despite the intricacies of market sector and individual models, all fuel types have shown a dip in average Retail Price on the previous week. There has been marked concern of late as to the Hybrid pricing position and this shows that in the last week there has been a large drop of -16.9%. This is not to say that the position may not significantly improve next week but it is clear that the balance of retail consumer demand on supply is having quite an effect. Talk of the Road to 2030 and the shift to BEVs and Hybrids is prevalent at the moment, and a variety of human decision-based forecasts are in being punted around the market. Retail fact-based insight is the only way to have a clear view and eliminate the subjectivity.

To conclude, the second week of February has not been the most encouraging of weeks either for the economy or the automotive sector. The cynical negativity that the nation is pre-disposed to, needs paradigm shift and maybe the improvement in the weather, the number of people vaccinated in the country and the governments plan to bring the country out of lockdown will improve matters. Using Cazana realtime market data, will help your business identify opportunities and maximise on commercial performance in a fair and transparent way.