The automotive market continues its current path of varied activity and differing performance metrics week on week, which indicates that at the moment consumer demand appears less consistent than it has been for some weeks. Having said that, the week commencing August 2nd has been more positive than the previous 4 weeks and there is a possibility that the used car market may stabilise during August, which would be a good result for the industry as a whole.

The SMMT released the new car registration data for July 2021 last week and the results were not good with the new car market having declined by -29.5% when compared to the same period in 2020. This is a direct reflection of the difficulty in sourcing new car stock and the position has been getting worse week by week and shows little sign of abating in the near future. Not only does this cause problems for franchised retailers with new car targets and financial forecasts based on new car sales, but it also puts pressure on the used car market and retail pricing. This position of poor new car availability and increasing pressure on used car retail prices across the whole market may have a negative impact on consumer demand with the perception that cars may be cheaper in a few months’ time which would be a shame. However, as it stands there is still a reasonably steady flow of enquiries both online and at retailer premises, despite the fact that it is the holiday season.

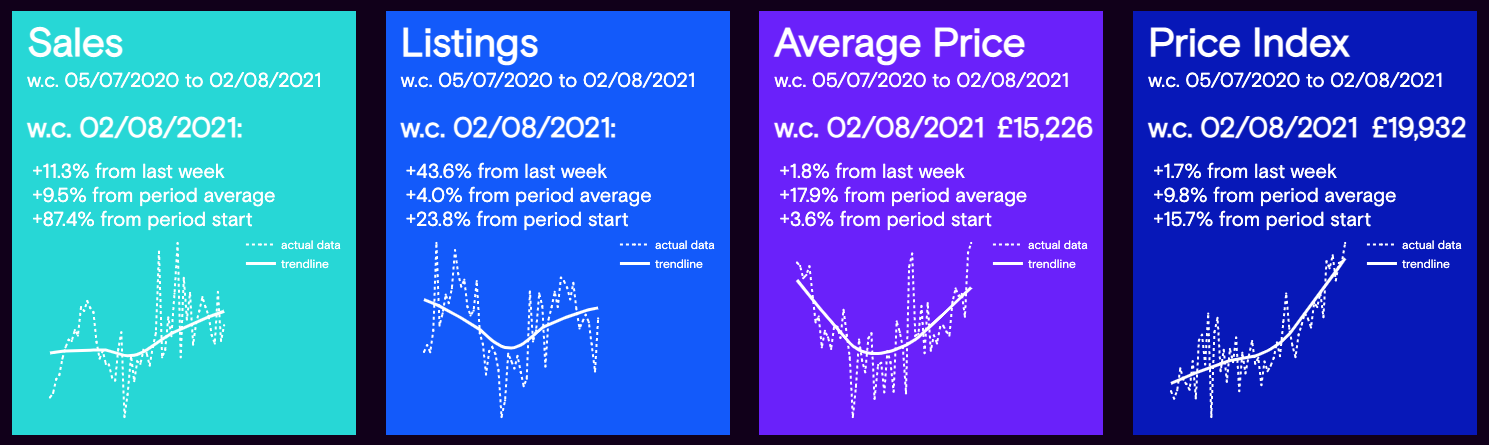

The panels below highlight the market dynamics during the week commencing August 2nd in comparison to the previous week. At the same time, the panels also show the full year trend of the stated data period shown in the charts at the bottom of each panel: -

Data powered by Cazana.

The Sales Data panel clearly shows that used car sales volumes improved by +11.3% when compared to the previous week which is a good step forward given the sales volumes in the last month. This week’s activity largely negates the -12.8% decline recorded in the last week of July. The expectation is that at worst sales levels will stabilise for the coming weeks.

Positive news is apparent in the New Retail Listings panel where the data shows an increase in new listings of +43.6% over the previous week. This is an interesting figure given that the availability of used stock in the wholesale market had been getting progressively worse in recent weeks, but there has clearly been a bounce back. Alternatively, or perhaps consecutively, there may have been an industry wide improvement in the preparation time of used car stock driven by reportedly lower levels of staff being “pinged” out of being able to work by the NHS COVID app.

Looking at retail pricing and the data continues to go from strength to strength, with the average retail price of a car increasing by +1.8% to £15,226. The Cazana Used Car Retail Price Index has also continued to climb with an improvement of +1.7% on the previous week in the normalised data. It really is astounding to look at the full year data trend and see how The Cazana Used Car Retail Price Index has consistently improved and stabilised week on week since the volatility during the summer of 2020.

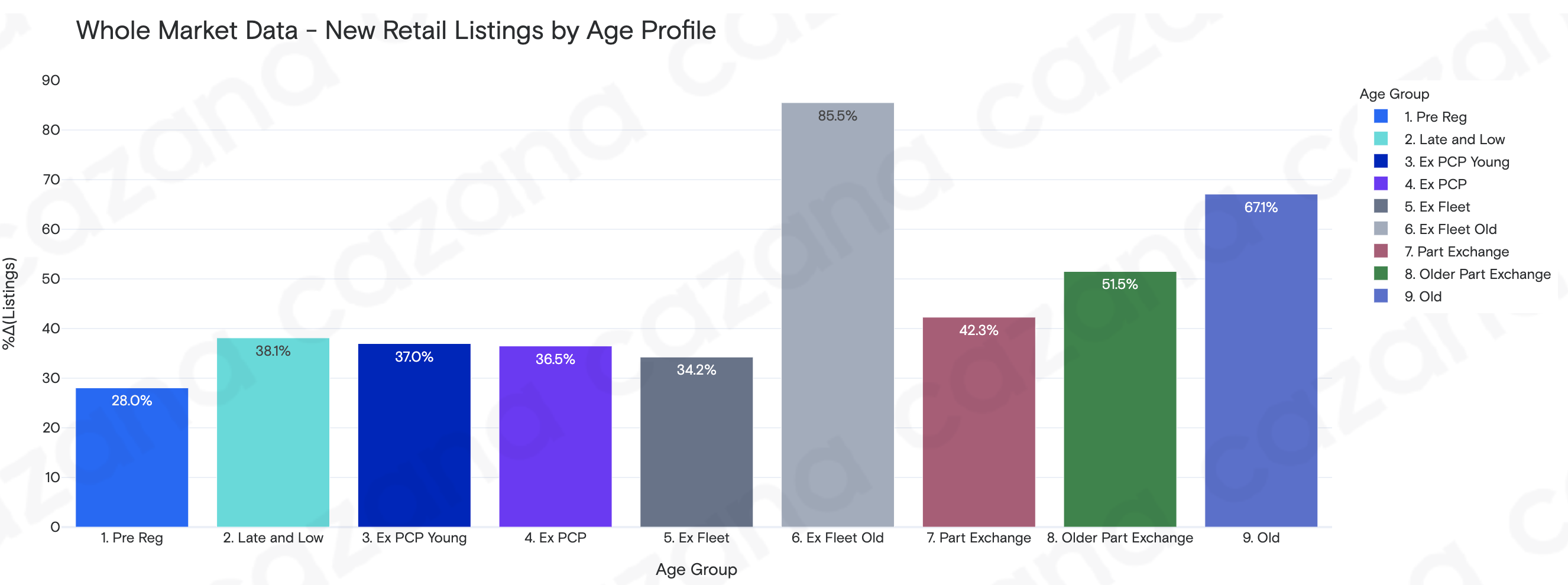

Using a different lens on the data, the chart below highlights the week on week increase in new retail advert listings by age profile: -

Data powered by Cazana.

This chart is very valuable as it quantifies the age profiles that have seen the greatest improvement in the number of retail listings week on week. Essentially, the largest increases in volume have been for the older age profiles with a specifically large jump for the Old Car age profile which represents cars over 10 years old. Older age profiles have proven to be more volatile than the younger age profiles in the last few months which is both worth remembering and also investigating in more detail using Cazana’s live whole market data.

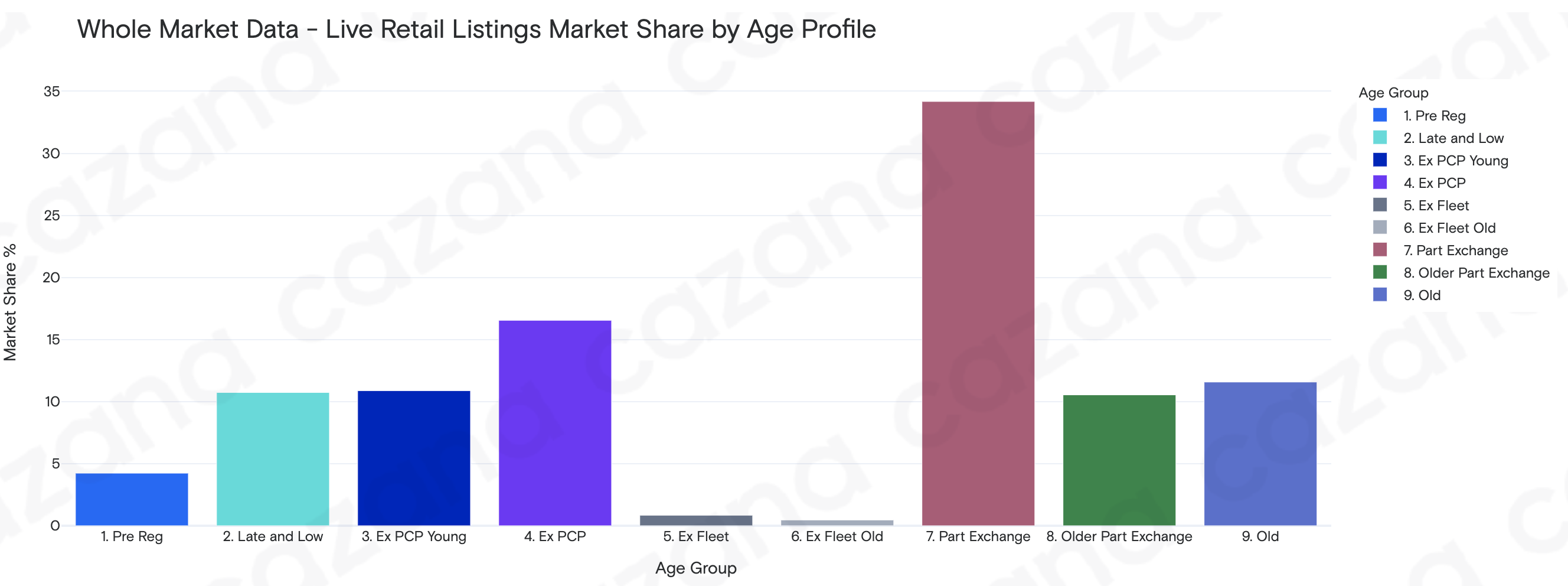

The chart below qualifies the significance of the previous chart by looking at the total market share of the current live retail listings in the whole car market by age profile: -

Data powered by Cazana.

The data in this chart shows that it is the Part Exchange profile that holds the largest market share of Live Retail Listings, accounting for over 34% of the total used car market at the moment. Ex PCP holds second place with 16.5% of the market share and then the Old Car profile with 11.5%. Of note is that cars in the age profiles over 4 and half years old hold 57.6% of the total market share. Therefore when there are changes to the data of the scale seen in the New Retail Listings chart, it can have a significant impact on the market dynamic.

In conclusion, the automotive sector in the last week has seen a welcome improvement in both sales and new retail advert listings. Breadth of choice is key for the retail consumer and therefore, the importance of having rising numbers of used cars on sale in the market cannot be underestimated as it is very closely linked to sales success. The coming weeks are typically stable and relaxed as consumers enjoy holidays and family time before the new and used car markets gear up for the new reg plate coming on September 1st. With such a restriction on new car availability, it will be interesting to see what happens to the UK and Global Automotive sectors. Using real-time whole market data from Cazana is the best way to ensure your commercial strategy is on point in order to maximise profit opportunity and stock turn.