New and used car sales activity in the last week has not been as positive as the industry would have liked or indeed expected after an extended period of strong enquiry levels and high sales volumes that started over a year ago. From a used car perspective, the volume of online and onsite sales enquiries took a marked dip during the week commencing July 5th and retailers have had to work extra hard at getting retail pricing at the right level to generate buyer interest. As such retail consumer demand would appear to have faltered over the last 3 weeks, although there is belief that this is a temporary blip.

This is an interesting shift in demand and comes at a time where some retailers have been paying strong money for certain cars at the auctions and through online remarketing channels. Feedback from the wholesale environment overall has also confirmed that demand for used cars, whilst still good, has waned for some models from various OEMs in the last 7 days, and that the auction conversion rates have now also slipped slightly with trade pricing stabilised for the time being. All this considered, the market is still behaving well, but just not as strongly as it has of late, and the declining sales volumes in recent weeks have now become a trend that is really rather unwelcome.

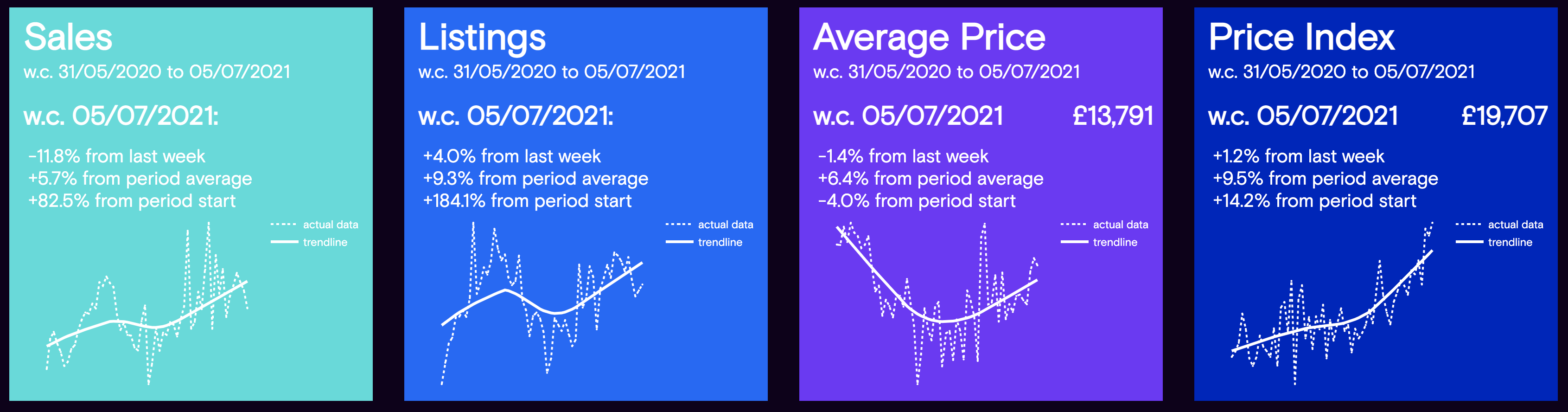

The charts below summarise and qualify the market dynamics during the week commencing July 5th compared with the previous week, and also show the full year trend of the stated data period shown at the bottom of each panel: -

Data powered by Cazana.

Starting with the full year data period at the bottom of each coloured panel, it is prudent to highlight the very varied nature of the data for each KPI, although the market wide Sales performance chart shows a higher level of volatility of late. This data also makes it clear that used car sales have dropped by -11.8% from the previous week, and as already acknowledged, this marks a decline in sales volumes for 3 weeks straight and is therefore a trend, albeit unwelcome. At the same time, the volume of new retail advert listings has increased for the second week running, perhaps highlighting that this is the opportunity for the used car stock availability to improve giving the retail consumer a bit more choice.

Looking specifically at what has happened with retail pricing and the data shows that the average retail price of a car in the used car market has declined by -1.4% in the last week, taking the figure to £13,791. This perhaps signifies that there were more older vehicles sold in the used car market and this position is worthy of further exploration. However, at the same time, the Cazana Used Car Retail Price Index increased by +1.2% and this is based on normalised market data. Either way, between these two data points, it is clear that there has been no significant detrimental effect on retail pricing given the dip in retail sales volumes across the market over the last 3 weeks. Indeed, this might lend weight to the discussion that has formed around the exaggerated volume of extreme price changes that have been reported by the trade and national press of late.

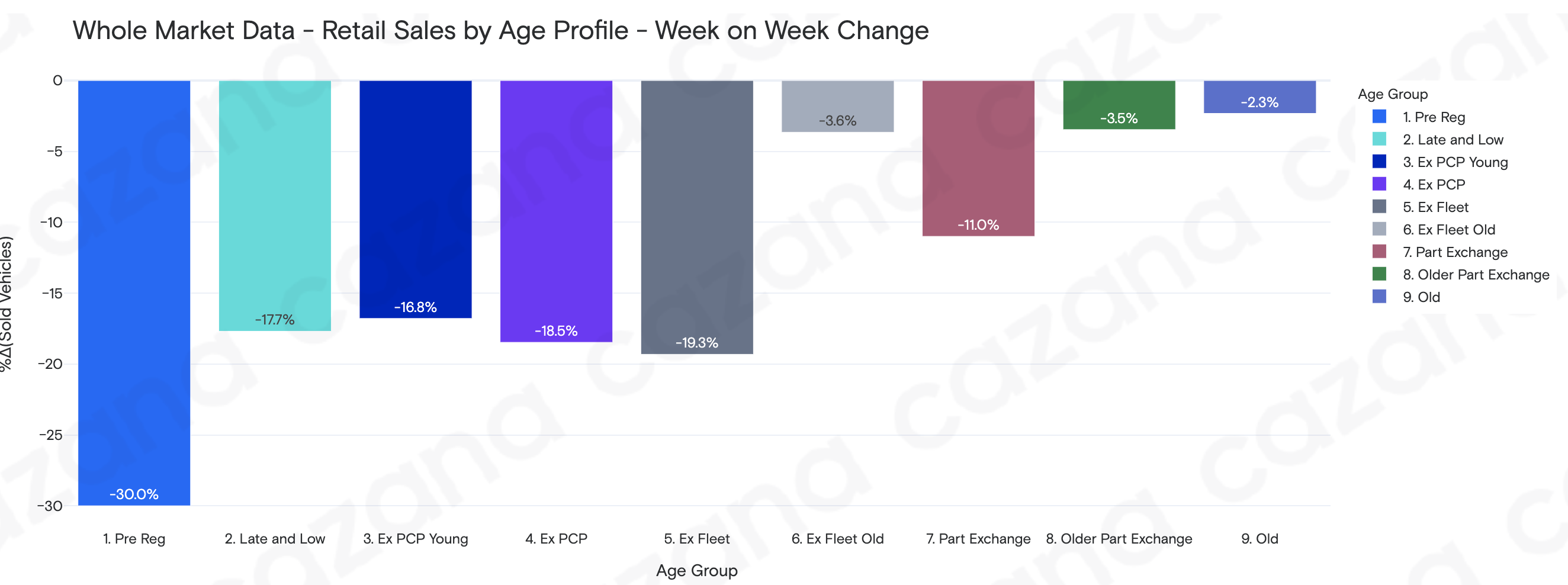

With retail sales showing such a drop in volume from July 5th to the previous week, the chart below looks at how the individual age profiles performed week on week from a sales perspective: -

Data powered by Cazana.

The data in this chart is very clear and shows a decline in sales of younger vehicles that has led to the overall drop of -11.8% in sales volumes week on week. Of specific note is the -30% drop in sales of Pre Reg profile cars. In previous weeks, there had been a great deal of speculation as to why Pre Reg sales had been increasing with the volume of cars on sale also growing, and this is the first sign that the restricted volumes of new cars in the market might now be influencing activity in the used car market.

Of equal note is the fact that the decline in sales volumes for the older age profiles is far lighter than for newer cars. This sector of the market has been strong for some time although the Old Car sales profile is the most volatile week on week often showing draconian swings. There has also been another burst of concern in the press over the use of public transport for getting to and from work, which can boost old car sales as people are reminded that they can choose to purchase a cheap car for commuting rather than rely on public transport.

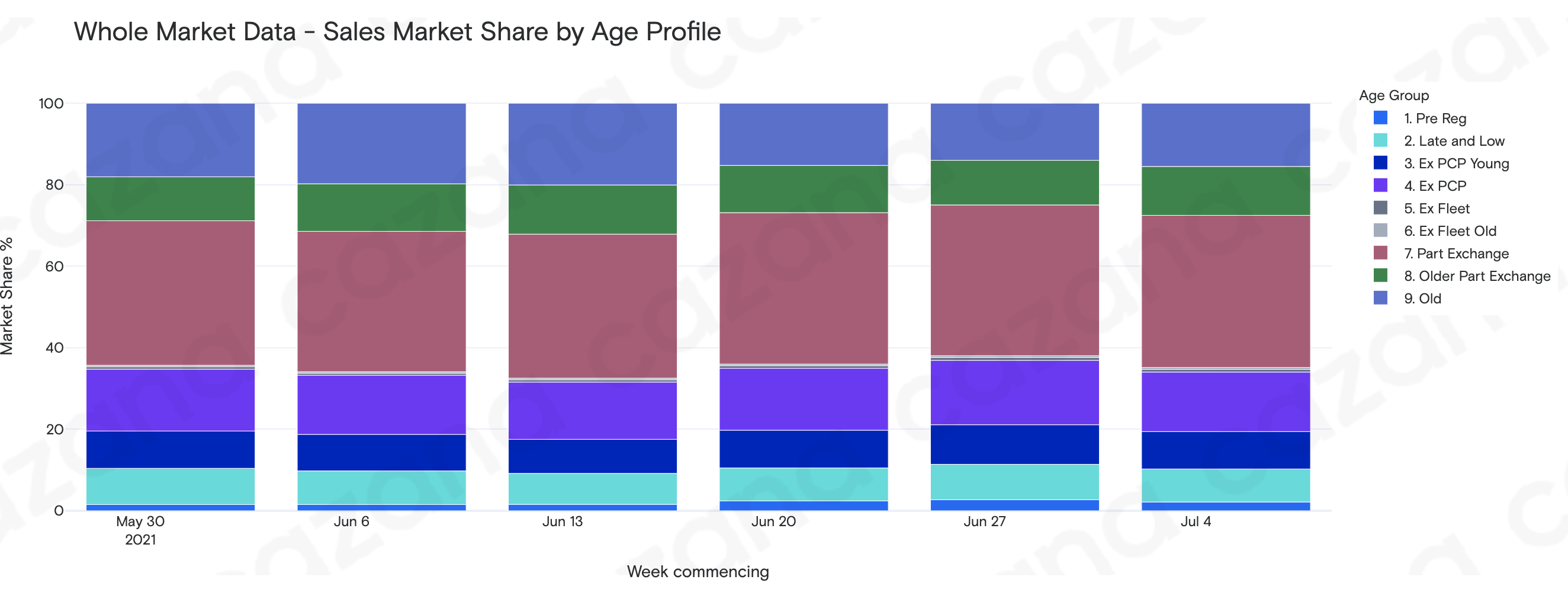

The chart below shows the volume of sales as a percentage of total market share by age profile to give scale to the importance of the lower decline in sales volumes for the older car age profiles : -

Data powered by Cazana.

The previous chart clearly shows the scale of the volume of sales within the older car profiles. Between the Part Exchange profile, the Older Part Exchange profile and the Old Car profile, retail sales account for 64.8% of all used car sales. In ranking terms, they take 2 of the top 3 volume sectors with Ex PCP taking the second largest share. As such, sales performance for cars in these age profiles need to be watched very closely which is why the strong overall sales performance in the second chart is encouraging to see.

To conclude, the market in the last 3 weeks has developed a downward trend in sales volumes. This is perhaps due to a stall in consumer confidence, as it remained at the same level during June as it was in May which was unexpected. This is in part due to the government delay in the removal of the lockdown measures until July 19th, and also the fact that there are still so few countries on the government holiday green list. In addition, the country has been in the grip of sporting suspense as England battled their way to the finals of the delayed Euro 2020 event and it is well known that major sporting events often impact retail spending patterns. Now the event is over, there is a possibility of a slight boost to sales from a small amount of pent-up demand. Using real-time retail driven insight will put retailers, remarketers, and lenders in the best place to understand the market shifts and develop strategies to maximise sales and ROI.