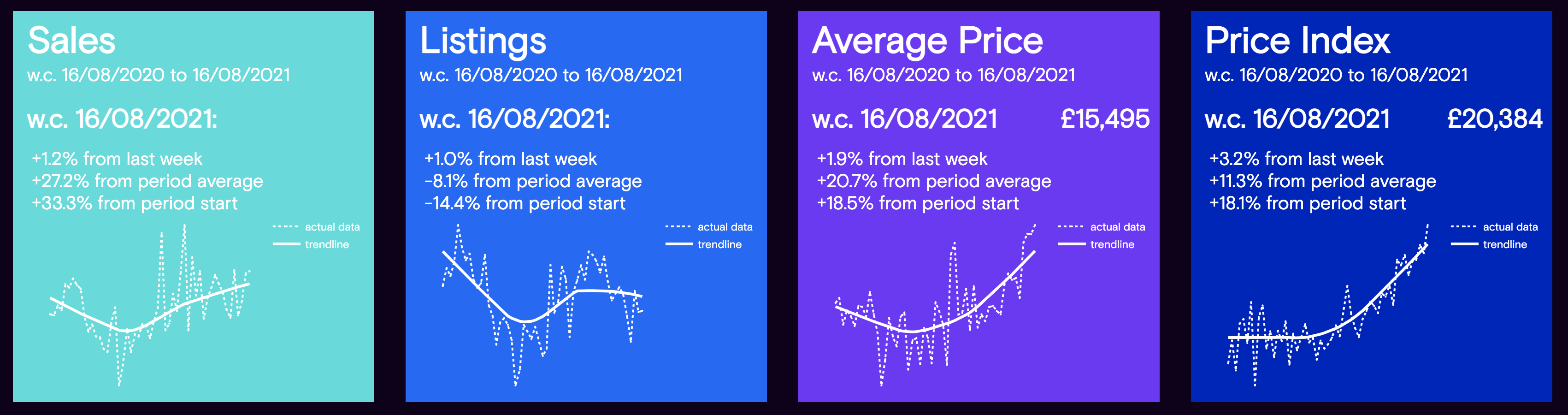

Sales have pushed above their already elevated position from last week with a 1.2% increase week-on-week. New listings also increased slightly, by 1%, but at a much more subdued level compared to previous weeks. In the context of a week where we have heard more news of manufacturers such as Toyota, Ford and Volkswagen continuing to reduce supply of new cars in response to the global chip shortage, it may be unsurprising that increasingly long delivery schedules for new vehicles is pushing consumers to the used market.

Data powered by Cazana.

Prices have also continued to rise despite already being at record highs for the last year. The Cazana price index, our normalised measure of vehicle pricing, was up 3.2% week-on-week, and a huge 12% above the average for the last year. The movement of consumers from the new vehicle market with larger budgets and presumably buying newer cars could explain some of this increase, along with dealers and dealer groups adjusting their pricing in response to current market dynamics.

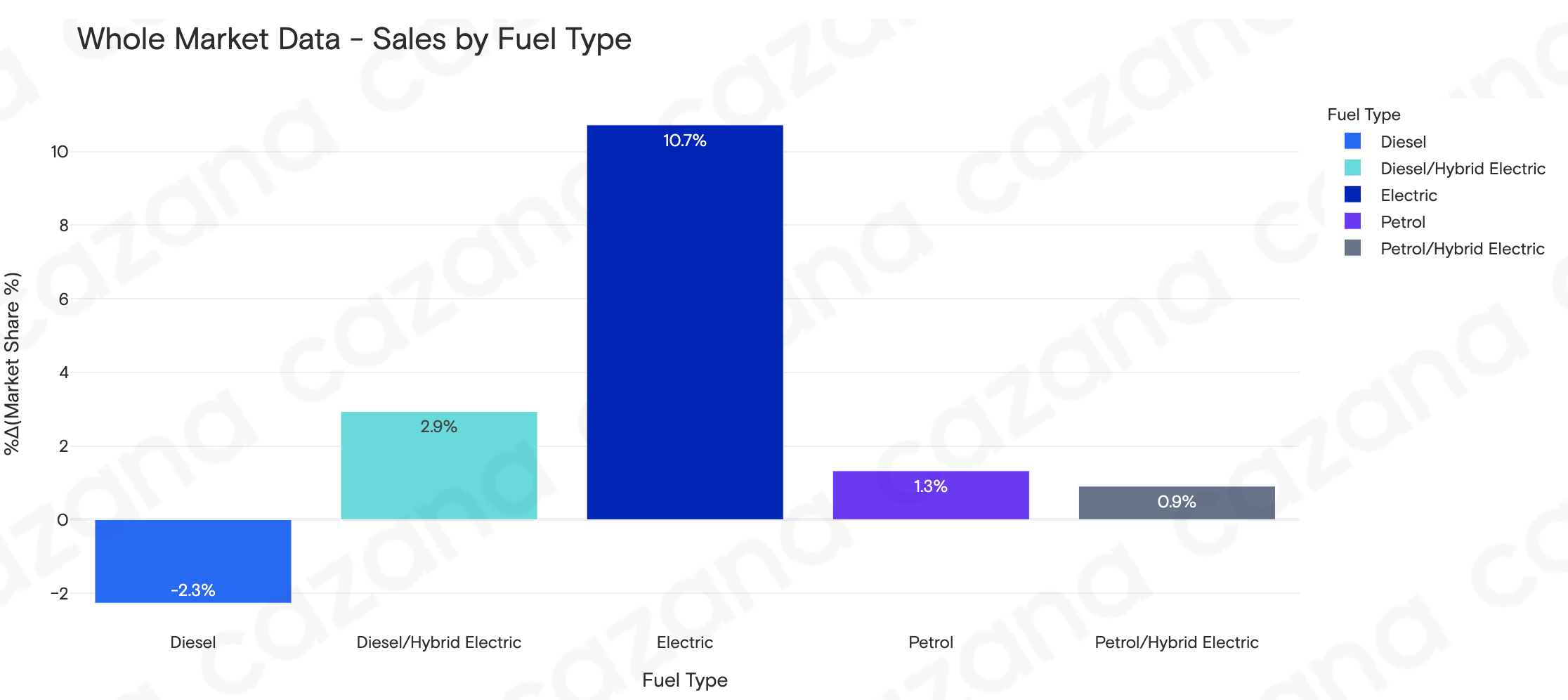

It is also of importance to investigate the relative differences in sales performance by fuel type, the graph below looks at week-on-week changes in retail sales by fuel type: -

Data powered by Cazana.

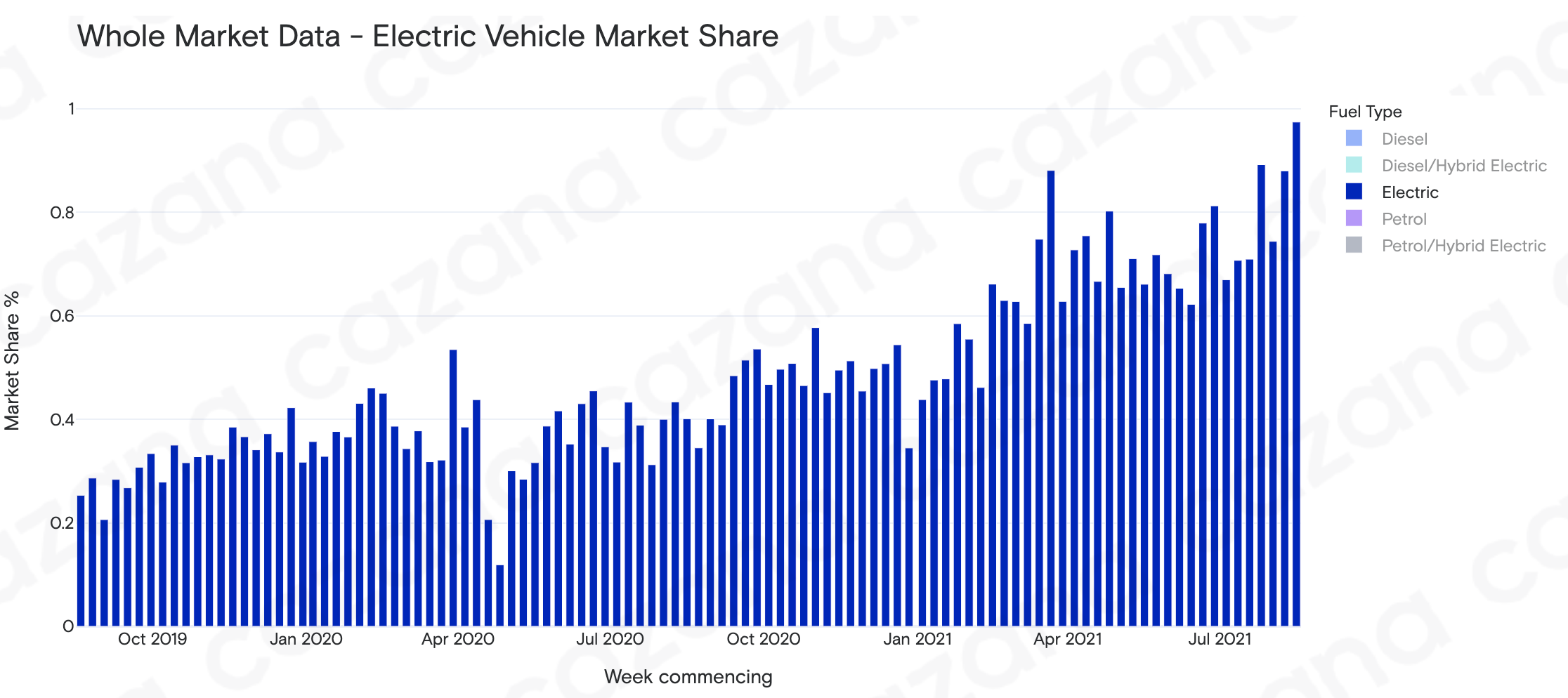

Looking at the graph above, we can see that Electric Vehicle sales have climbed by 10.7% week on week. Electric Vehicles currently have an around 1% market share of the UK used car market. Although this has been increasing at a consistent and rapid pace over the last year. The graph below explores this increasing market trend over the last two years: -

Data powered by Cazana.

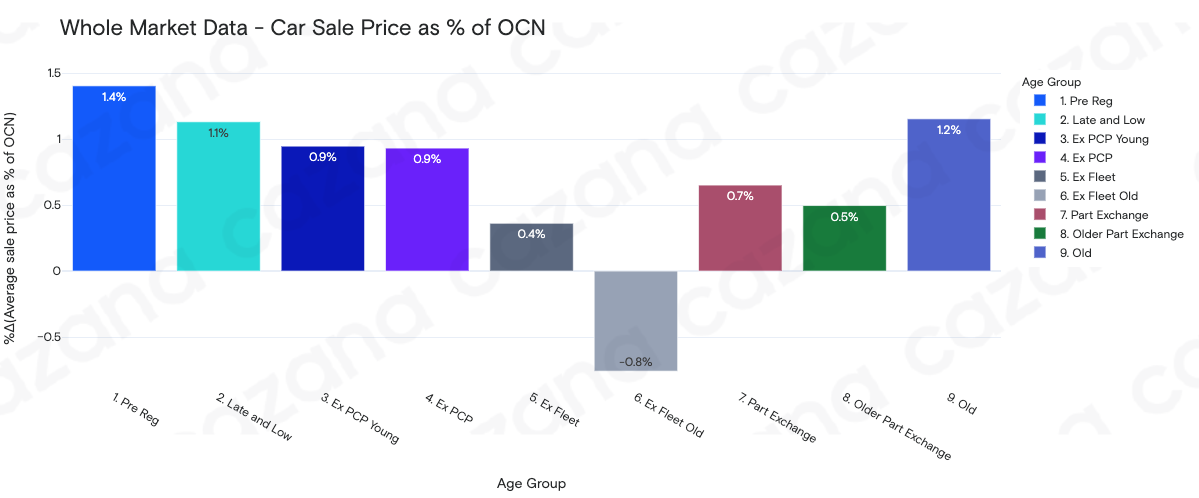

With pricing remaining at an extremely elevated position, it is also worth exploring how this is spread across the used car market. The below graph the change in pricing by vehicle age band: -

Data powered by Cazana.

The graph above shows the pre-reg vehicle group having the biggest increase in pricing since last week, which is in line with increased demand in this age group as a result of displaced buyers of new vehicles.

In summary, Used Car Market performance has remained strong for the week; but just how much this performance is being held up by externalities affecting the new car market remains to be seen. Using Cazana real-time data will help identify where the commercial opportunities lie in the coming weeks. Whether your business is remarketing wholesale stock or retailing to the consumer, factual unedited data is key to success.