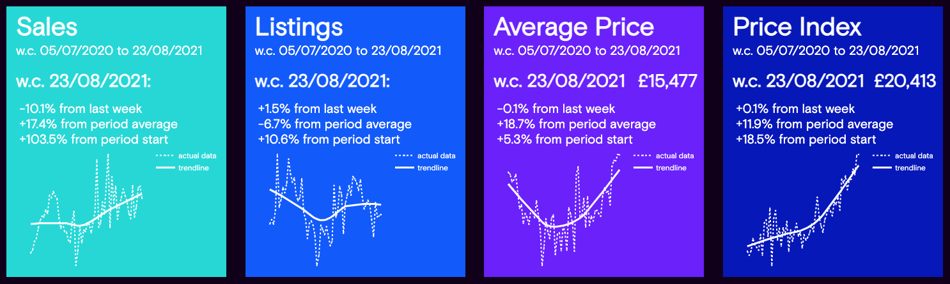

Another week of low volumes of new listings, at 6.7% below the average number seen per week over the last year. This reduced supply seems to now be beginning to affect sales volumes, which dipped by 10.1% week on week. Although, it is worth bearing in mind that this drop should be contextualised by the fact that sales are still 17.4% above average for the last year, and 103.5% above where they were a year ago. However, if new listings remain low, as we would expect based on the continued news emerging of chip shortage and global supply chain issues, then we can expect sales to drop further.

Data powered by Cazana.

Data powered by Cazana.

Pricing has continued to rise, although only very slightly week on week, with The Cazana Price Index (our normalised measure of vehicle pricing) rising very slightly by 0.1% and holding steady at nearly 12% above the average seen over the last year. This continued elevation of vehicle pricing suggests that the drop we have seen in sales is due to supply-side issues, rather than consumer demand.

Data powered by Cazana.

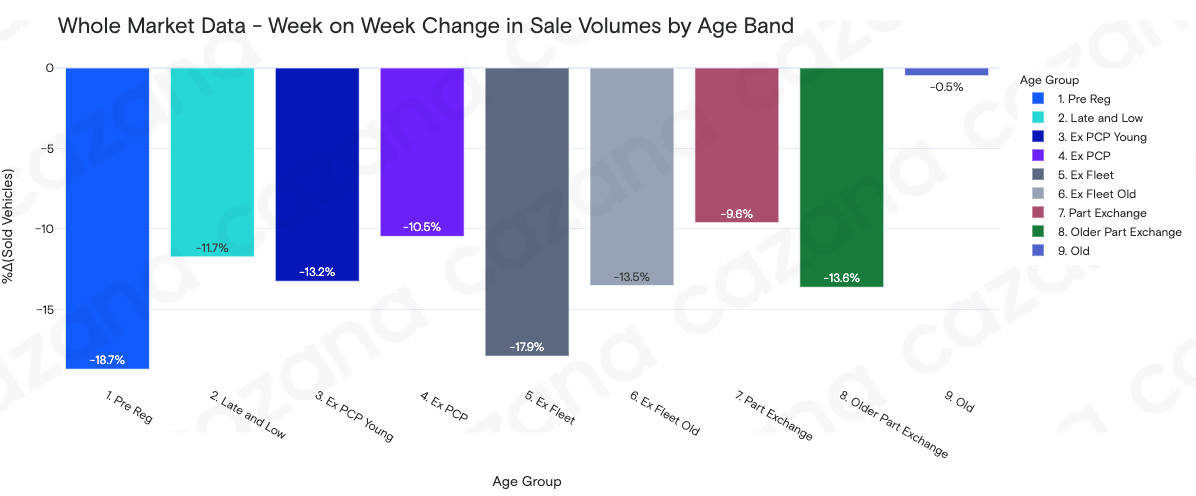

Looking at the graph above, we can see that the drop in sales volumes for this week hit Pre-Registered vehicles, with older vehicles only seeing a marginal 0.5% drop. This is because of limited supply of pre-registered vehicles, due to supply issues for new vehicles.

Data powered by Cazana.

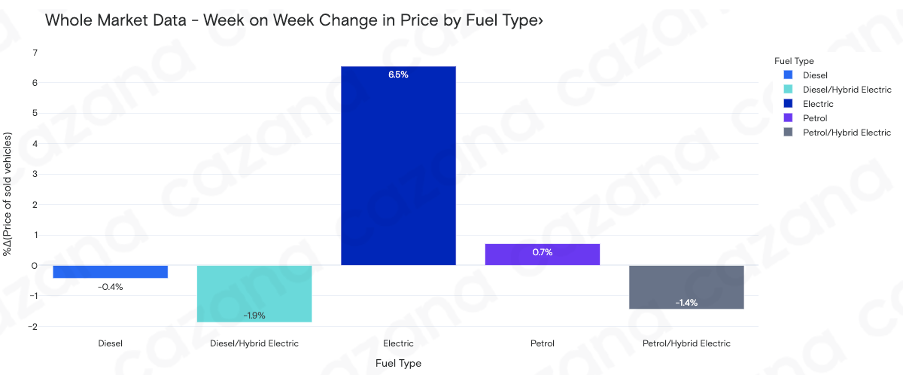

Any increase in pricing appears to have been led by Electric Vehicles, which showed a week-on-week price increase of 6.5%. Way ahead of conventional and hybrid fuelled vehicles. Electric Vehicle market share dipped slightly to 0.9% of the used car market, but this still represents an increase of over 100% from the beginning of 2021.

In summary, it appears that the used vehicle market is showing some signs of slowing, however this appears to be mostly due to supply difficulties. Consumer demand seems strong and is still supporting very inflated prices across all segments of the used car market.