Used car market activity bounced back with a big increase in used car sales reported over the course of the last week. The volume of leads improved noticeably and the number of customers buying both online and in the car showrooms surged upwards. It looks as though the Bank Holiday weekend was the fillip that was needed to get things moving once again, and the pent-up demand that some thought had ended two weeks after the retail showrooms opened is still very much in evidence. Social distancing has meant that some retailers are operating on an appointment only basis, and this has brought some frustration as there have not been enough slots to meet customer demand. However, the online buying options have also remained extremely popular with retail car buyers.

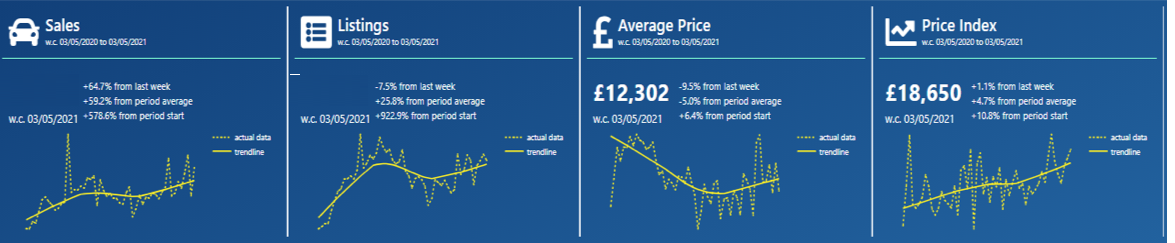

The charts below qualify the market dynamics during the previous week with the full year trend of the data shown at the bottom in yellow: -

Data powered by Cazana

It is clear from the data above that last week was a fabulous sales period with the number of used cars sold up by +64.7% which is excellent news for the automotive sector overall. The full year chart trends show an upward shift across the KPIs, although the Average Price of a car in the used car market has dipped by -9.5% in the previous 7 days. This is possibly due to an influx of older cars to the used car sector or, and perhaps also as a result of, high volumes of more expensive cars being sold to customers in the market.

It is also important to note that the Cazana Used Car Retail Price Index has increased by +1.1% from the previous week. This heralds an uplift of +10.8% since the period start date of May 3rd 2020 and is higher than certain data providers see using lower more restricted data volumes, highlighting the importance of using real-time whole market data. Smaller pricing sets tend to give a less accurate view of the market and with the used car sector performing as it is at the moment, understanding every nuance in the market performance is essential to stay ahead of competitors.

With used car sales volumes at their current level, there is a very real possibility that the used car stock position will get worse in the coming weeks. Tactical activity on pricing is a shot in the foot at times like this and the majority of businesses have been shrewd enough not to have had sale events in the last couple of weeks. Indeed, we know the data shows that retail pricing is increasing overall, and this is essential to ensure that margins remain at a manageable level to be able to show a profit and support the business strategy. At the same time appropriate margins are essential to be able to prepare and market the car effectively whilst also allowing for the cost of customer care and service post sale.

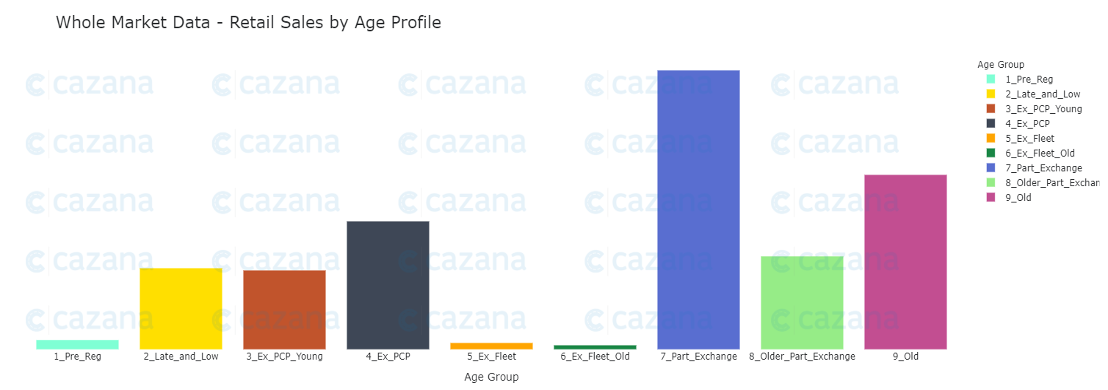

Looking at the market position in a little more detail and the chart below puts a lens on sales by Age Profile in the market: -

Data powered by Cazana

This chart qualifies that the majority of sales in the last week were for cars over 4 years in age which is interesting. Sales trends for older cars over the course of the last year have tended to be more volatile than younger ones, and the shift week on week has often be quite large. In this instance, the majority of the sold cars were in the Part Exchange sector which comprises of vehicles that are between the ages of 4 and 7 years highlighted by the blue bar in the chart.

These are also sales that would most likely take place in non franchised retailers due to the age and mileage of the product. Perhaps this is a further indication of pent-up demand for cars that arguably have been bought from retailers that did not have the capability to transact easily online during the lockdown period.

The poorer performance from a used car perspective appears to have been for ex Fleet product that is firstly not around in any great volume at the moment, and secondly for the Pre Reg profile which is also low on stock due to new car restrictions and improved new car sales levels.

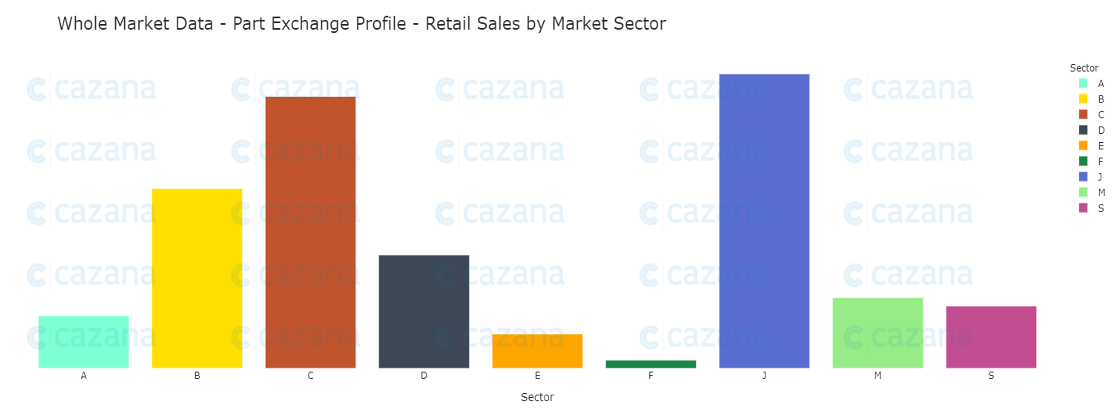

The chart below delves into market performance in more detail: -

Data powered by Cazana

This chart looks at the sales performance of Part Exchange vehicles by market sector to try and identify whether there are any specific areas of concern. Of immediate note are the healthy sales levels for J Sector SUVs, indicating that the family market demand is strong for this type of car such as the Nissan Qashqai and Renault Captur at this age profile. This is closely followed by sales for C sector Medium size cars such as the Ford Focus and Vauxhall Astra which are again family cars. Of equal note is the low volume of sales for F Sector luxury cars and E Sector executive cars and this is of note as these sectors are often popular for the Part Exchange age profile.

As such it is clear that the last week has seen a revitalisation of the used car market that had experienced a quiet patch after a couple of weeks of frenetic sales activity. Consumer demand was back to the previous high levels enjoyed as the car showrooms re-opened and it is likely that this demand will continue at this level for some weeks to come. The two potential clouds on the horizon are whether retail consumers will divert spending to other retail markets such as DIY or holidays and there is the underlying issue of used car stock availability. Either way, the most effective way for lenders, remarketers, and retailers to make the most of the current commercial opportunities is to use real-time retail driven insight based on whole market unedited data that only Cazana can supply.