Up to 77% of the value of a brand-new vehicle can vanish over a 3-year period, while some used cars can depreciate by more than 20% within the first 12 months of ownership.

Used car depreciation is a major risk to any motorist, especially if the motor is subject to a finance agreement. Guaranteed Asset Protection (GAP) insurance can be taken out on new and used vehicles. Depending on how long the vehicle has been owned, policies can offer to cover the vehicle’s current ‘value’ or to the value on the purchase invoice.

Vehicle theft has accounted for around one in seven crimes in recent years, and the number of cars written off in accidents is ever-increasing. As the economy continues to struggle, it is sadly usually associated with a trend of increasing fraud as some people become desperate to make ends meet from financial hardship. GAP insurance brokers have seen an increase in fraud involving Guaranteed Asset Protection (GAP) insurance claims, these include Staged Thefts and accidents and fault / damage claims

GAP insurance policies bridge the difference between what the main insurer has paid and what the owner has paid to buy the car in the first place. At the time that a car is stolen or involved in an accident, the car may be worth less than the remaining finance. This is where GAP insurance policies can be put to the test by fraudsters who are after financial gain.

In the insurance fraud industry there is often talk of red flags and key fraud indicators when assessing claims and accident circumstances. These are generally behaviours or inconsistencies which suggest a claim may not be entirely genuine and closer scrutiny is required. Being able to identify the pattern in fraudulent claims can be a lengthy and a time-consuming task, gathering the best data for effective analysis has been a challenge for underwriting and claims departments.

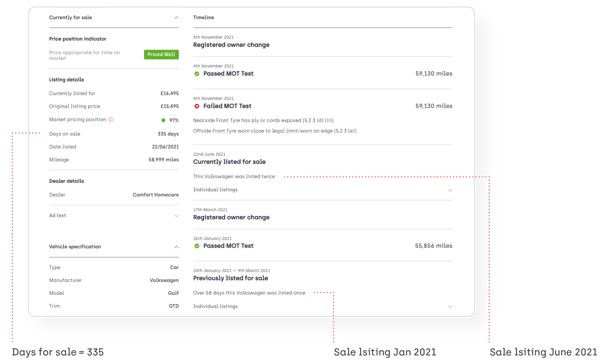

This is where Cazoo Data Services’ data can support GAP insurance brokers. Our database combines historic vehicle data with information from the DVLA, DVSA and MOT history. By using our data, GAP insurance brokers can identify pre-existing damage, check for modifications, identify sale listings including past and present advertisements, whether private (e.g Facebook marketplace) or main Dealerships (e.g. We buy Any Car).

With its user-friendly interface, providing direct access to hundreds of historical, current and future data points in real time in just a few clicks :

- Rich Vehicle values , Valuations / Market forecasting

- MOTs & test results, VRM, number plate, and keepers

- Detailed timeline of sales events & sales ads - both private & dealers

All of this combined in our user-friendly Companion Tool means GAP insurers brokers have everything they need in one place. Therefore, for policy fraudsters who tried and failed to sell the vehicle before it was "stolen, crashed or caught fire", GAP insurance brokers have access to several red flag indicators, right up to the date of the investigation into the claim and can offer a fair and accurate vehicle valuation with detailed, backed up data that can be supplied as a customised offer, tailored to the customers' needs and location.

Our tools are relied on by some of the biggest names in insurance including Financial Ombudsman, Direct Line, NFU Mutual, Esure and Covea Insurance. We work with insurers, brokers, engineers and price comparison websites of every shape/size, powering the complete customer cycle, providing data-derived insights from quote through to claim.

If you’re ready to take that next step toward digital transformation with advanced innovations that enable a highly competitive business, contact one of our experts at sales@data.cazoo.co.uk or complete the contact form online.

To keep up to date with all the latest news about Cazoo Data Services and the industry, you can follow us on Twitter, LinkedIn, or visit our Website.